Best Cta Balance Sheet

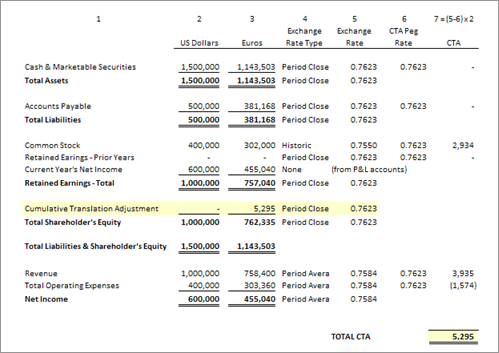

As you can see this defines the Total Asset row and Total Liabilities and Equity row on your balance sheet.

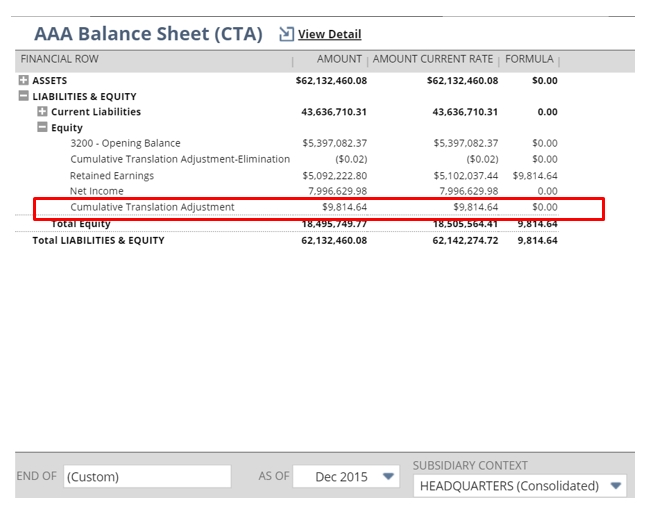

Cta balance sheet. The CTA is used on the consolidated balance sheet to make it balance. Featured here the Balance Sheet for CTA which summarizes the companys financial position including assets liabilities and shareholder equity for each of the latest 4 period. The Cumulative Translation Adjustment CTA as a special type of account required when multi-currencies in NetSuite OneWorld accounts are enabled and is only used on the consolidated balance sheets.

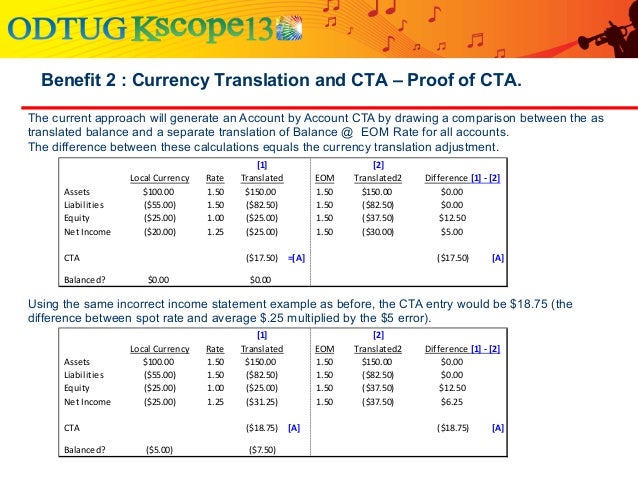

Ad Find How To Balance Sheet. These will be different numbers for your Balance sheet report. Currency translation adjustments or CTA result from changes in exchange rates with the cumulative amount residing in the equity section of the balance sheet.

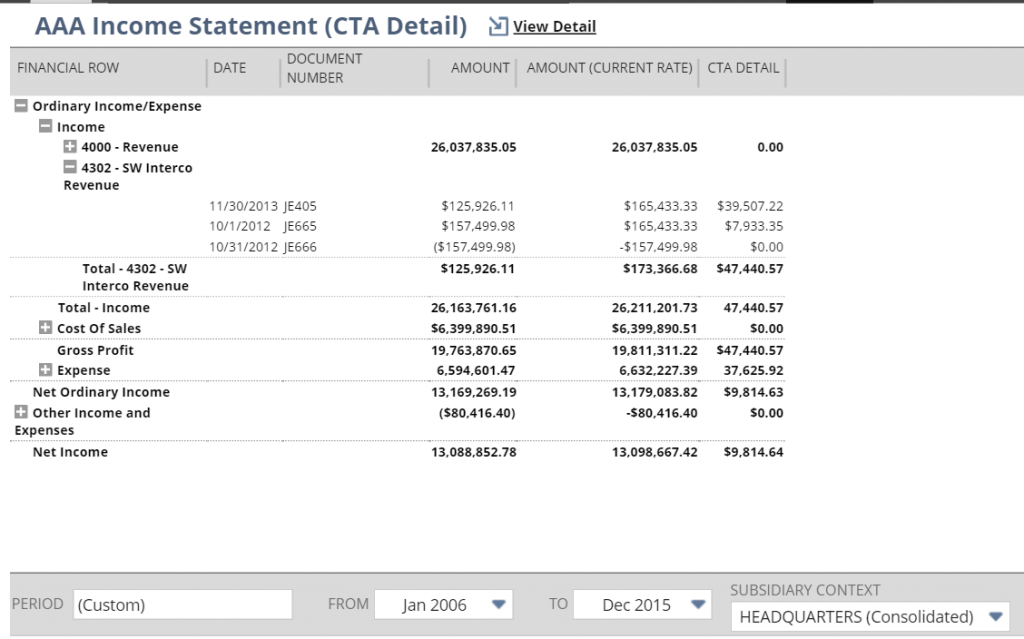

The CTA is a line item within the balance sheets accumulated other comprehensive income section that reports any gains or losses that have occurred because of exposure to foreign currency markets. Its easy to understand how it gets in there but the question of when it is eliminated is more complicated. CTA account is part of Owners Equity on the Balance Sheet for US-GAAP reporting purposes.

Changes In the Account dimension the FCCS_NetIncome member and. The CTA is carried as an unrealized gain or loss on the balance sheet which is realized when the subsidiary. CTA is not getting calculated as expected and the Balance Sheet is subsequently out of balance.

Another reason for CTA balance is typically Income statement accounts because transactions happen through out the month are converted at the average currency exchange rate for the month while balance sheet accounts are as ofbalance. Ad Find How To Balance Sheet. Note that the translation adjustment for 2009 is a positive 69000 credit balance.

The balance sheet is brought back into balance by creating a positive translation adjustment of 69000 that is treated as an increase in Stock holders Equity. CICTA Account CTA adjustments in a single Comprehensive Income CTA account CICTA can be captured as part of the Statement for Comprehensive Income for IFRS reporting purposes which aggregates to the balance sheet Other Reserves account. Create an account in GP called CTA.

/financial-statement--pen-and-calculator-on-table-1056767352-d0133bda50ef4ad688c48bb2f0065f32.jpg)