Perfect Goodwill Impairment Entry

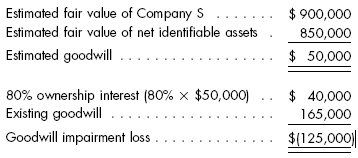

The impairment loss will be applied to write down the goodwill so that the intangible asset of goodwill that will appear on the group statement of financial position will be 270 300 30.

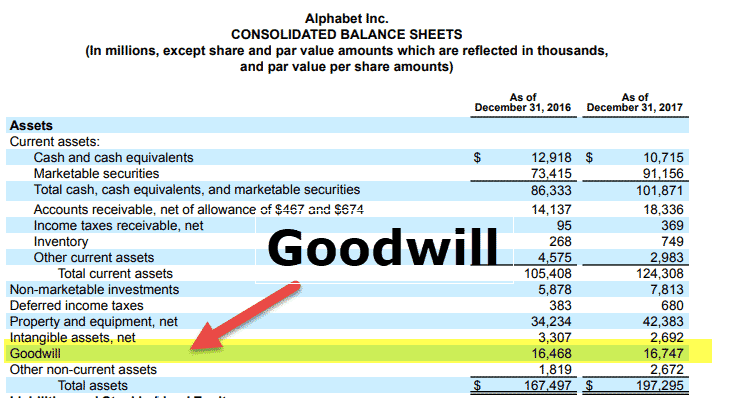

Goodwill impairment entry. Any impairment loss that arises is first allocated against the recognized and unrecognized goodwill in the normal proportion that the parent. Increase in goodwill asset. Goodwill impairment is an accounting charge that companies record when goodwills carrying value on financial statements exceeds its fair value.

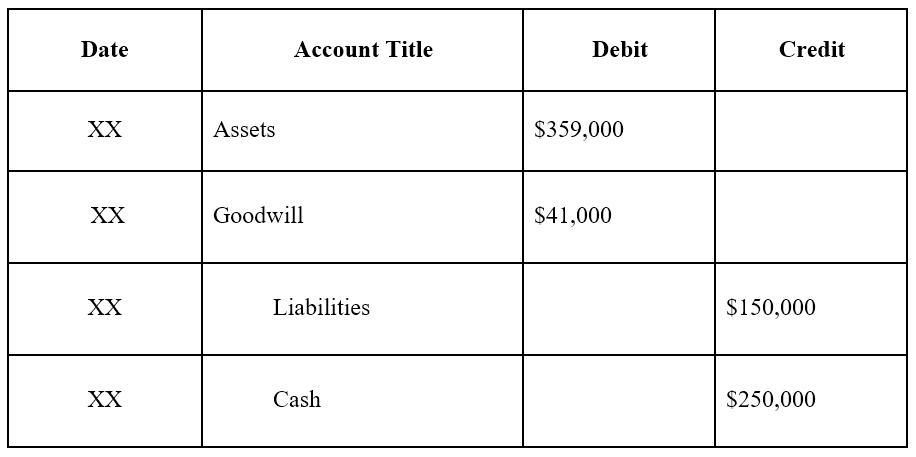

Goodwill is tested at least once a year for impairment o Compare assets carrying amount to its recoverable amount Fair value cost to sell OR Value in use o Goodwill emerges during consolidation elimination entry so impairment loss is done on consolidation adjustment entry Journal entry o Dr Impairment loss. It is intangible asset but we have to record it by passing following journal entry. Goodwill is a common byproduct of a business combination where the purchase price paid for the acquiree is higher than the fair values of the identifiable assets acquired.

Debit Profit or loss or Capital Account. In accounting goodwill is recorded after a company. If the goodwill account needs to be impaired an entry is needed in the general journal.

Goodwill impairment is an earnings charge that companies record on their income statements after they identify that there is persuasive evidence that the asset associated with the goodwill can no longer demonstrate financial results that were expected from it at the time of its purchase. Goodwill is not amortized. Following are the main journal entries of Goodwill.

Basic bookkeeping or double entry for taking up or writing off goodwill in the books of account of a businessWhen goodwill is ACQUIRED. Goodwill payment fair value of net assets 520000 500000 20000 4. When goodwill is WRITTEN OFF.

Goodwill should be tested for impairment annually. In the group statement of financial position the accumulated profits will be reduced 30. Goodwill impairment is when the carrying value of goodwill exceeds its fair value.