Casual Treatment Of Provision For Bad Debts In Cash Flow Statement

You see bad debts are not an actual flow of cash.

Treatment of provision for bad debts in cash flow statement. Creation of provision for doubtful debts. Provision for bad debtts is created by transfer of fund from profit and loss account. That gives you a more realistic picture of your businesss income than assuming every receivable will be paid in full.

They are expected losses from delinquent and bad debt. The provision for credit losses is treated as an expense on the companys financial statements. The bad debt provision reduces your accounts receivable to allow for customers who dont pay up.

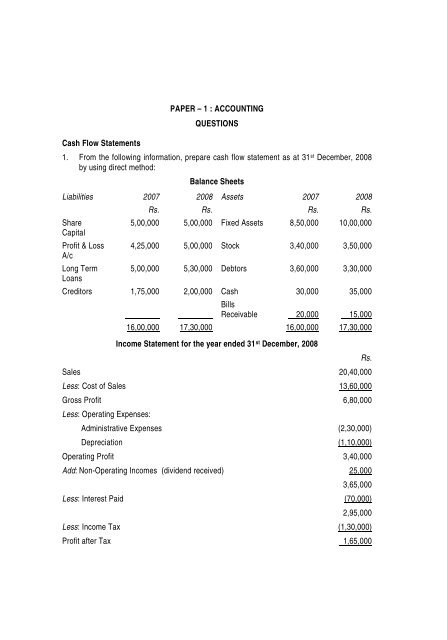

Thus the total debit to profit and loss account of Year 2015 would be 6820 ie. After the determination of cash flows from the operating activities investing activities and financing activities their results are calculated and added to ascertain the net change in cash and cash equivalents. Provision for Bad debts 1000 Short term loans 10000 19000 Creditors 15000 10000 Bills Receivable 20000.

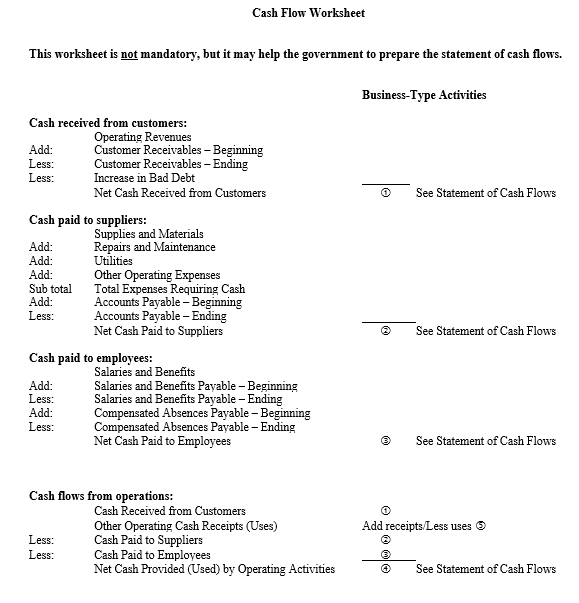

Writing bad debts off involves no cash so there is no treatment for it on the cash flow statement. Write about treatment of depreciation in a Cash Flow Statement5. Wht is the treatment of bad debts in cash flow statement under indirect method.

It may be included in the companys selling. A cash flow statement discloses net increase or decrease in cash during an accounting period. An additional provision would be made for only 1400.

The income statement considers bad debt as an. Recording decrease in provision for doubtful debts. Can you explain me the treatment of Provision for Bad debts in Cash flow statement under indirect method.