Supreme Balance Sheet Accrual Ratio

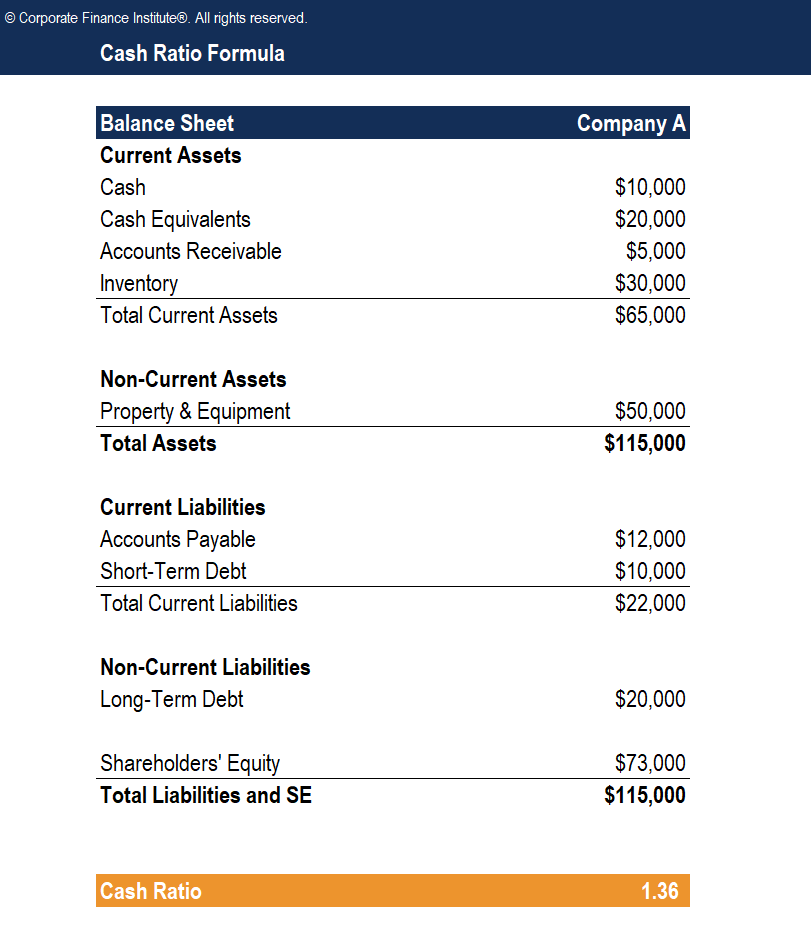

Balance sheet ratios evaluate a companys financial performance.

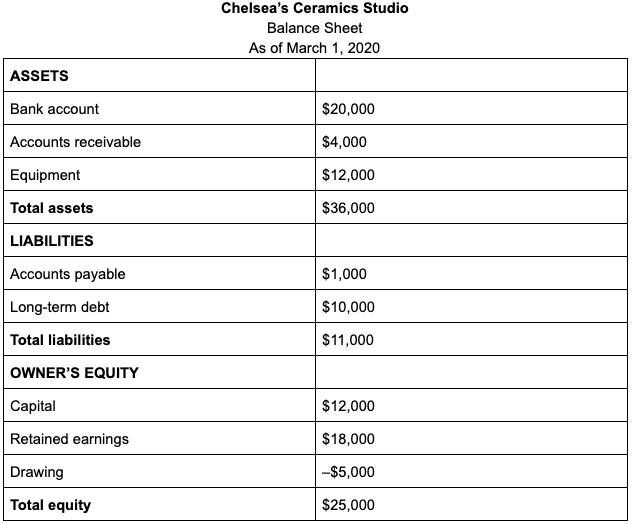

Balance sheet accrual ratio. Understanding Accrued Expense. Balance Sheet Accrual Ratio How Do You Calculate Retained Earnings On. Since accrued expenses represent a companys obligation to make future cash payments they are shown on a companys balance sheet as current liabilities.

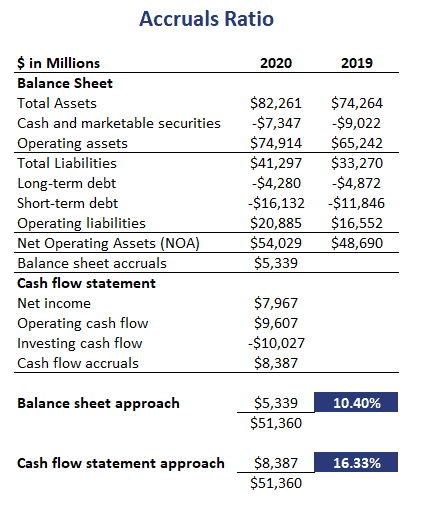

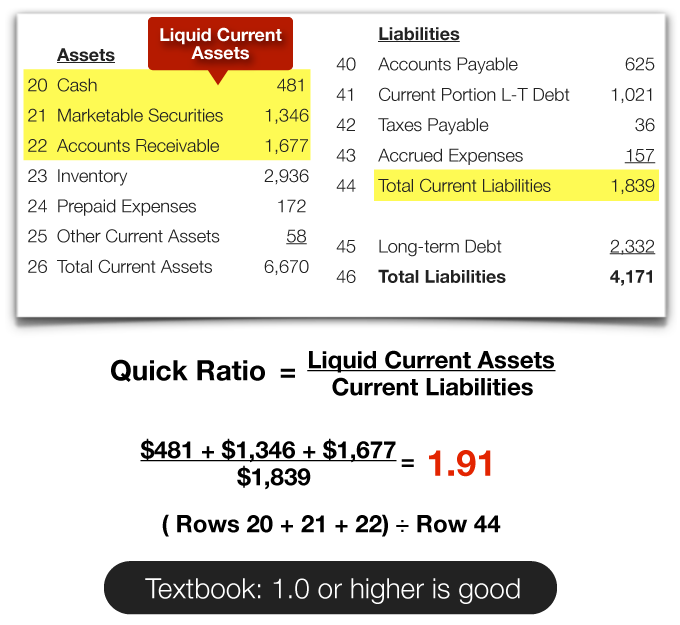

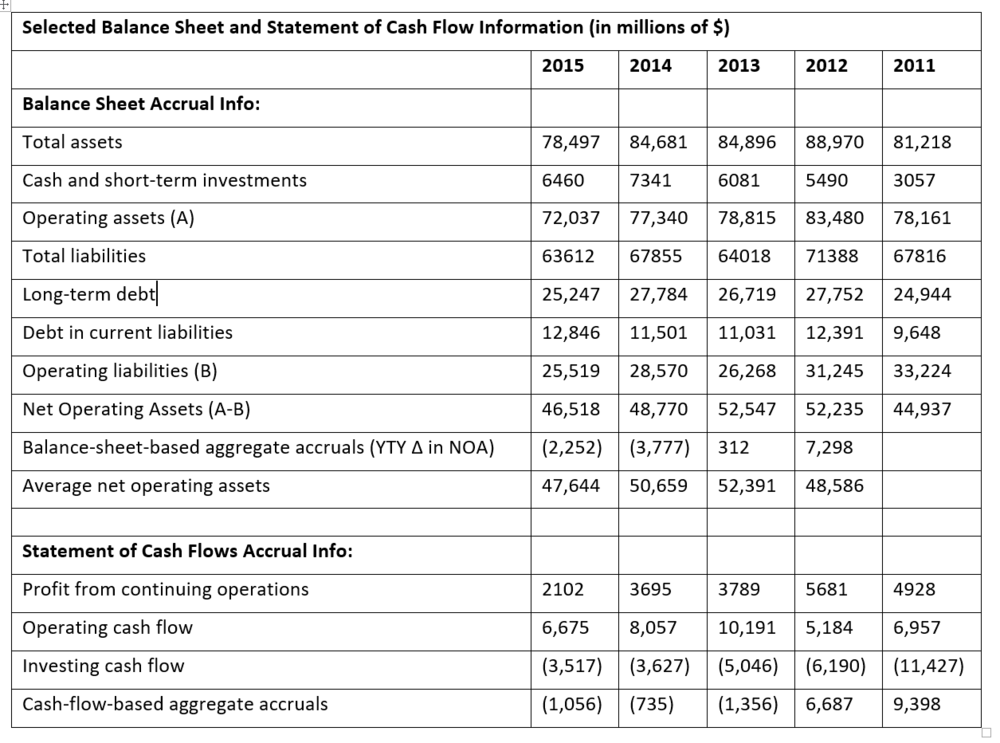

In this case we can measure accruals as the change in net operating assets over a certain period. Improved earnings quality from 2019 to 2020. Liquidity ratios demonstrate the ability to turn assets into cash quickly.

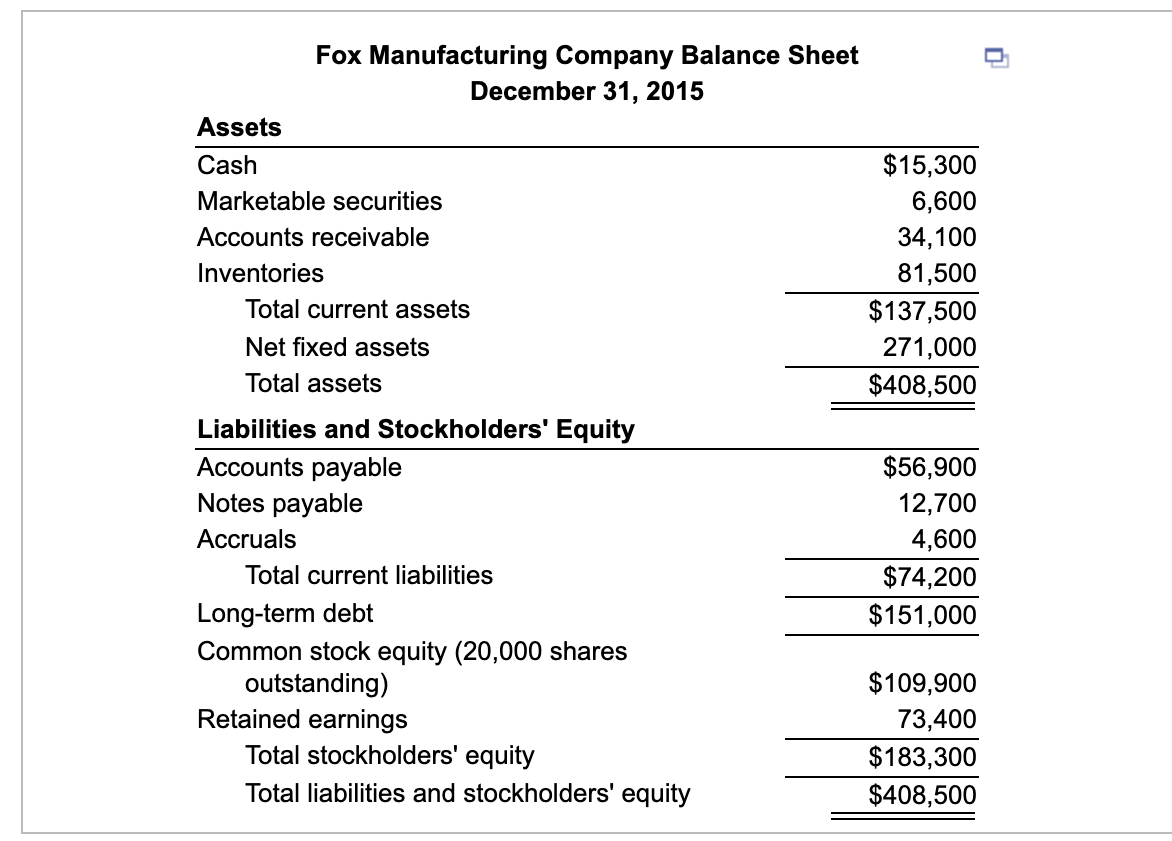

This is in part due. Given the nature of the accrued expenses they are recorded as Current Liabilities in the Balance Sheet. Net operating assets NOA is the difference between operating assets and operating liabilities.

What to Watch Out For With Accruals You now have the secret sauce to check accruals. This number is divided by the net operating assets. There are three types of ratios derived from the balance sheet.

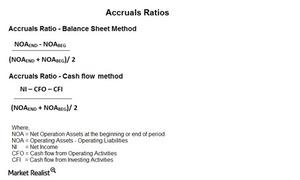

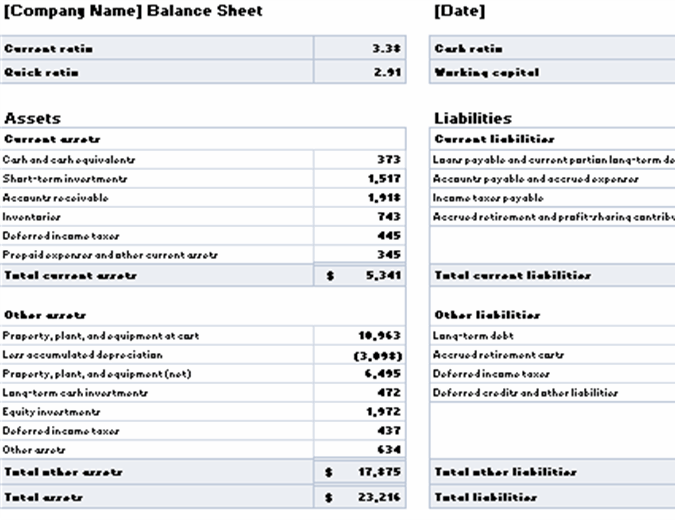

Accrual Ratio Balance Sheet Noa - Noa previous year Noa Noa previous year 2 Net operating assets Noa Total assets Cash - Total liabilities Total debt The ratio tells you what the change in net operating assets are compared to the average net. Company As cash-flow-based accrual ratio is 175 or 125000 - 25000 - 30000 40000. Ratio is found by dividing balance-sheet-based aggregate accruals by average net operating assets.

This is measured on a TTM basis and earnings are diluted and normalised. The balance sheet-based accrual ratio is used to judge how heavily the company depends on accruals to show a profit. 14 rows Calculate Balance Sheet Ratios With the balance sheet and income statement in the example above we can calculate the balance sheet ratios as below.