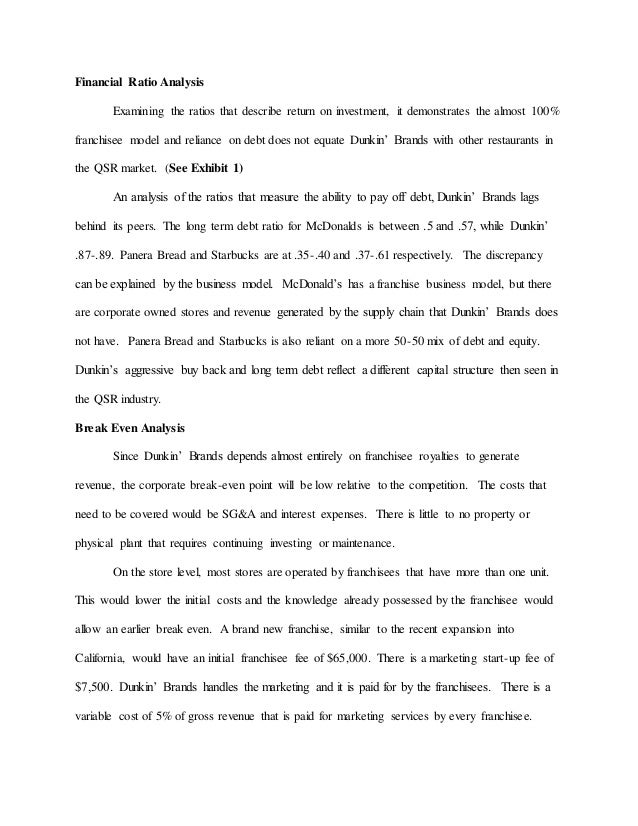

Ace Dunkin Donuts Financial Ratios

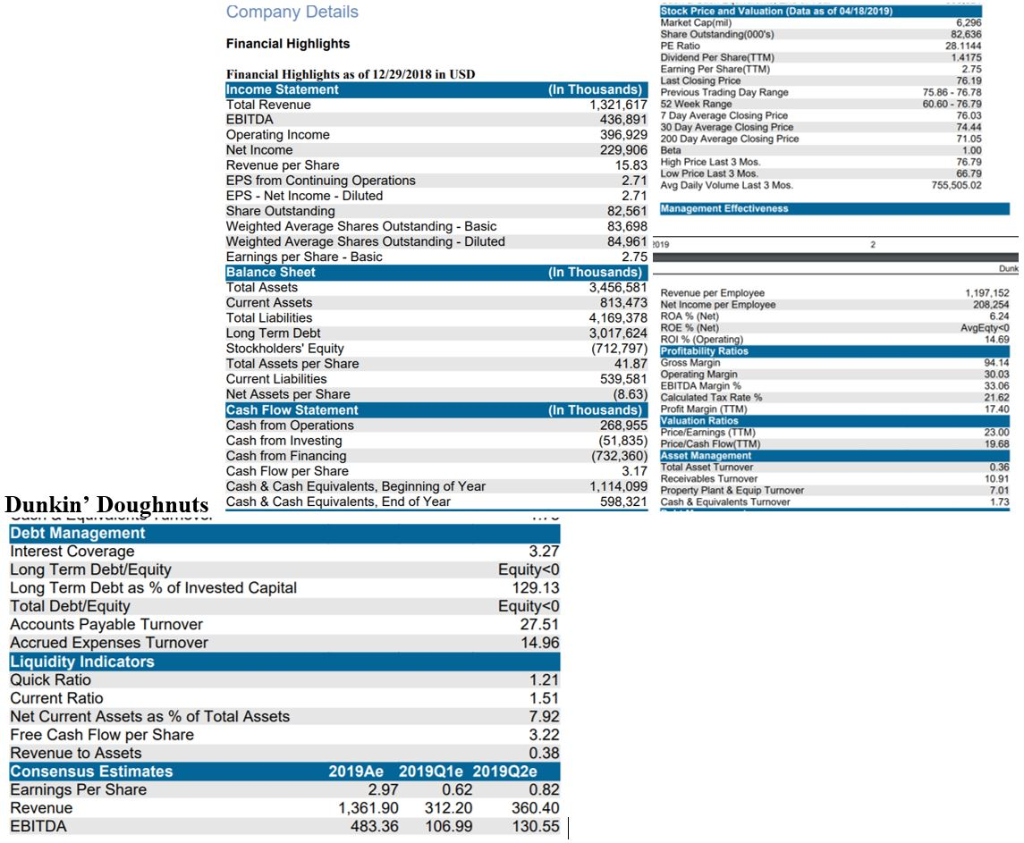

473 Dunkin Donuts has a high debt to equity ratio and their company is considered high risk because they are at risk of not being able to afford.

Dunkin donuts financial ratios. Visit DNKNs Balance sheet. Is significantly lower than the average of its sector Restaurants Bars. Financial analysts and individual investors use PE Ratio and PEG ratios to determine the financial performance of a business.

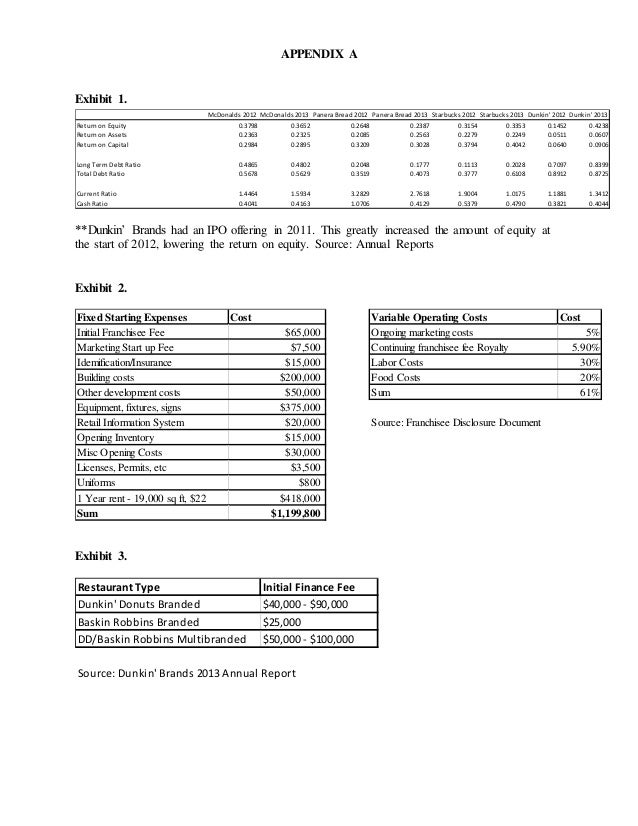

Dunkin Brands is a franchise of quick service restaurants selling hot and cold coffee baked goods. Debt to equity ratio. Financial Analysis Dunkin Donuts Company Summary 2014 Market Cap 39 Billion Shares Outstanding 104630978 shares Earnings Per Share 165 Current Dividend Price 106 Dividend Yield 249 PE Ratio 2546 Return on Equity 4793 Current Stock Price 4260 Introduction Dunkin Donuts is the Worlds Leading Franchisors of Quick Service Restaurants QSRs.

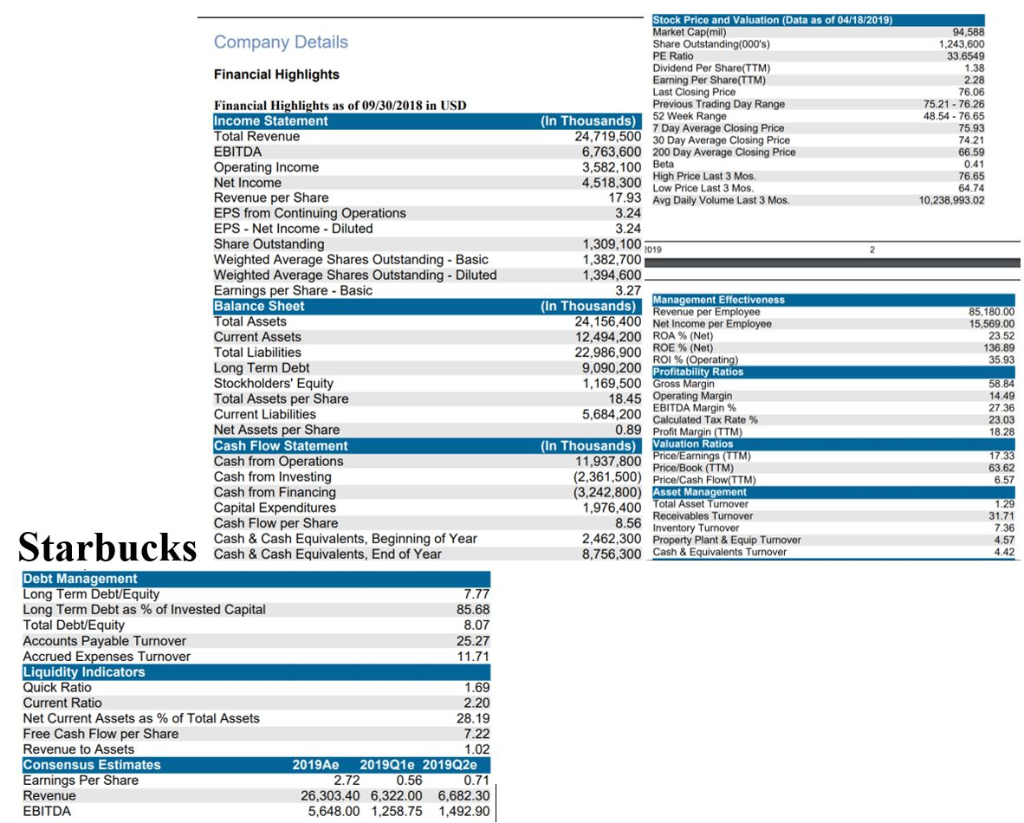

Dunkin Brands Key Financial Ratios Generally speaking Dunkin Brands financial ratios allow both analysts and investors to convert raw data from Dunkin Brands financial statements into concise actionable information that can be used to evaluate the performance of Dunkin Brands over time and compare it to other companies across industries. 2 above the third quartile. Starbucks has a larger footprint with over 30000 locations worldwide.

1 between the second and the third quartile. 0 the ratio value deviates from the median by no more than 5 of the difference between the median and the quartile closest to the ratio value. -1 between the first and the second quartile.

Source of DNKNs Sales. According to these financial ratios Dunkin Brands Group Incs valuation is way below the market valuation of its peer group. Revenues reflect DunkinDonuts US.

The NA ratio of Dunkin Brands Group Inc. It is the process that is widely used for identifying the financial weaknesses and strengths of the corporations this can be done by building the relationship between items of the profit loss account and balance sheet. Each ratio value is given a score ranging from -2 and 2 depending on its position relative to the quartiles -2 below the first quartile.