Great Prior Year Adjustment Disclosure

The company should still provide a disclosure explaining the prior period adjustment.

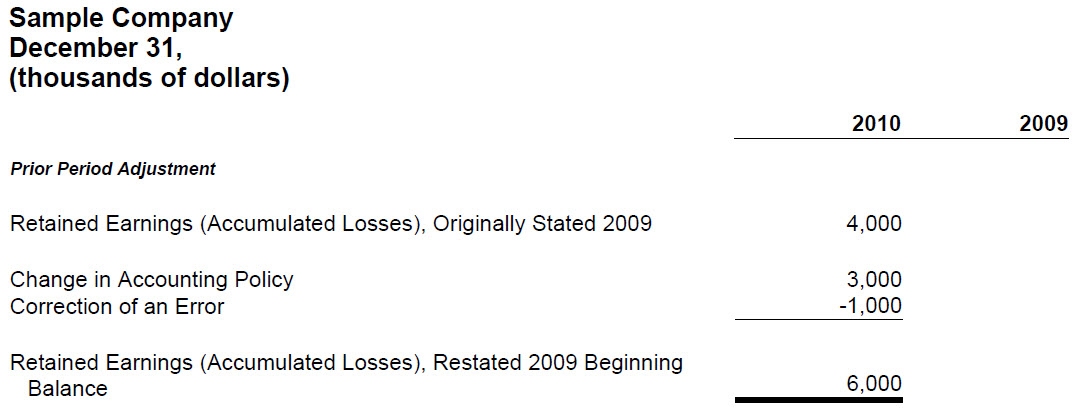

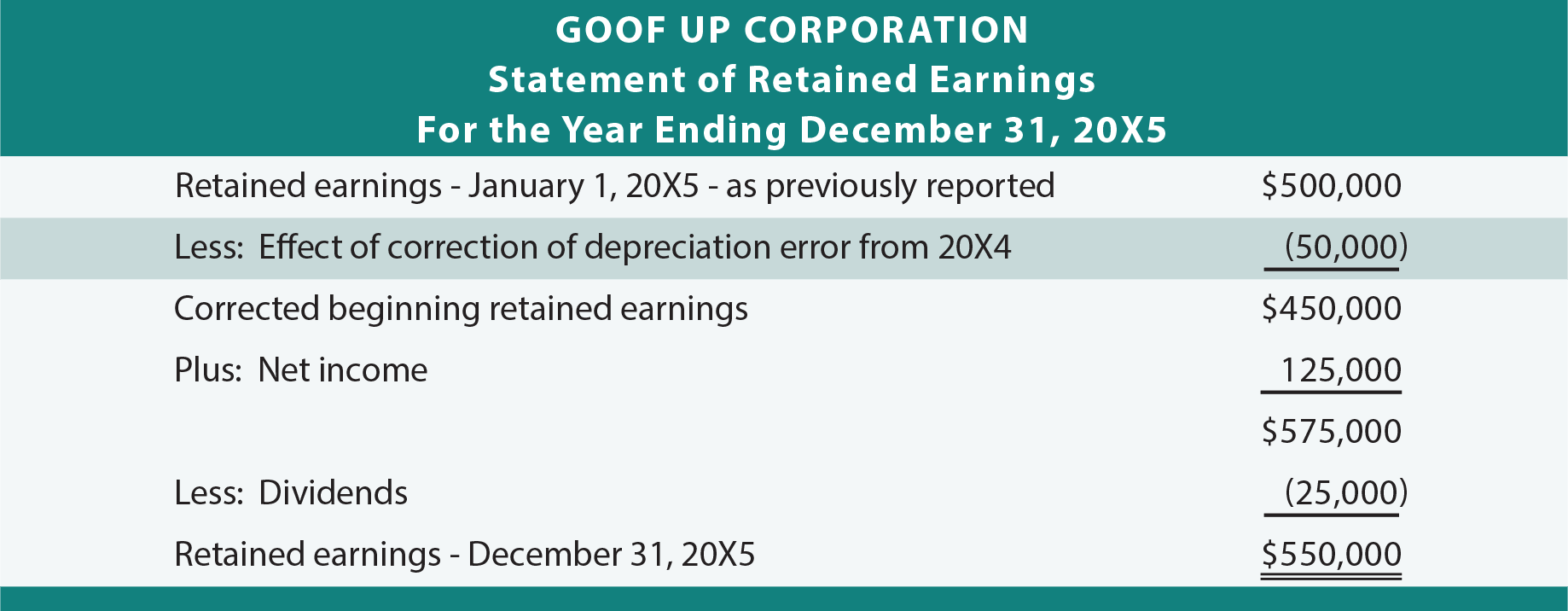

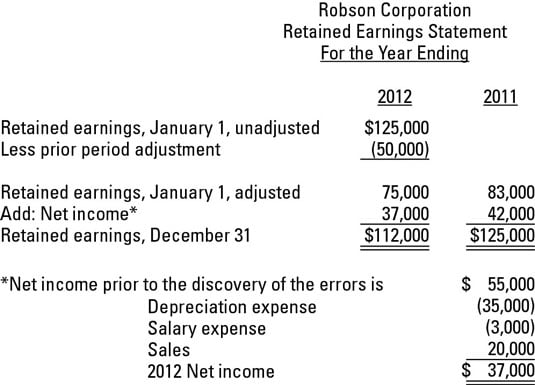

Prior year adjustment disclosure. The following is an example of a prior period error highlighting how this could be disclosed in a set of statutory accounts. Statement of changes in equity SOCIE Year ended 30 April 20XX Profit for the financial year Unrealised surplus on revaluation of certain fixed assets Prior year adjustment as explained in note 1. Report the total revised values including the net adjustment in the GST F7 of.

This is only if your errors do not affect boxes 9 to 12 14 and 15. IAS 829 the nature of the change in accounting policy. For example if XYZ Limited reported a lower depreciation amount an adjustment is made by debiting the retained earnings account and crediting the accumulated depreciation account in the current year.

Big R Restatement An error is corrected through a Big R restatement also referred to as re-issuance restatements when the error is material to the prior period financial statements. Consequently the Group has recognised multiple prior year adjustments as further explained in note 28 to the financial statements thus reducing net assets as at 31 March 2016 and 31 March 2015 by 15771000 and 4413000 respectively and reducing the profit for the year. Financial calendar or tax year basis.

Presents single year financial statements the prior period adjustment affects just the opening balance of retained earnings January 1 2019 in this example. A prior year adjustment in accounting is a correction of errors in a companys financial statements for the previous year. Open the previous accounting period within Accounts Production.

Prior period adjustments are discussed in SFAS 16 as amended in SFAS 109 and SFAS 154 and aim to separate economic events that affected prior years from those events that affect the current financial statements. If Mountain Bikes Inc. Sample Disclosure - Note On Correction Of Prior Year Errors 8 November 2009.

Under this approach the entity would correct the error in the current year comparative financial statements by adjusting the prior period information and adding disclosure of the error. Materiality is not only considered on prior year results but also on the current year. If you are making a prior period adjustment to an interim period of the current accounting year restate the interim period to reflect the impact of the adjustment.