Wonderful Interim Financial Reporting Meaning

Ad Are You Drowning in Meaningless Metrics.

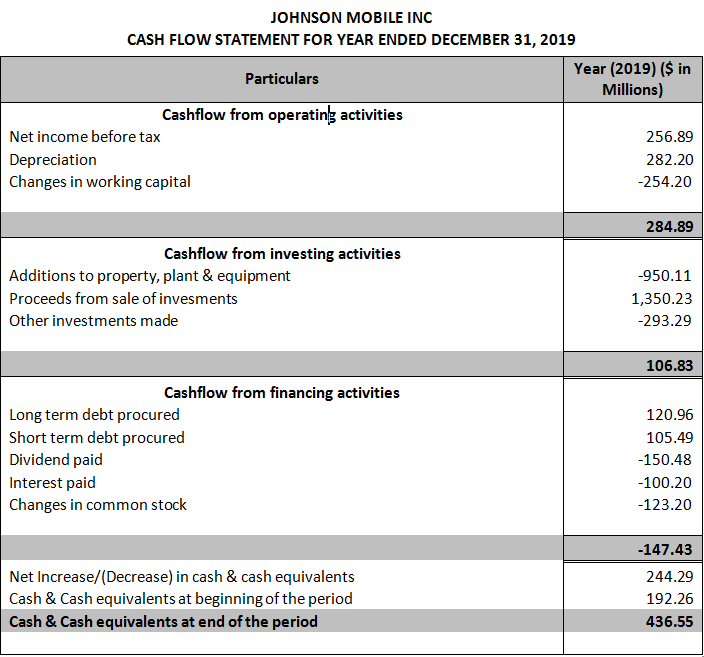

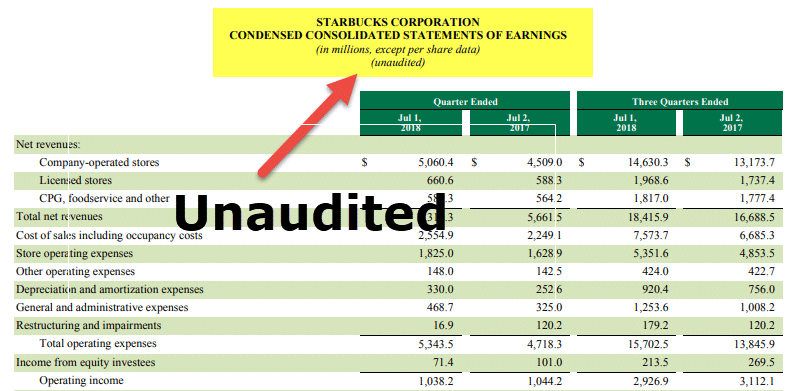

Interim financial reporting meaning. Timely and reliable interim financial reporting improves the ability of investors creditors and others to understand an enterprises capacity to generate earnings. Interim statements are used to convey the performance of a company before the. IAS 34 Interim Financial Reporting applies when an entity prepares an interim financial report without mandating when an entity should prepare such a report.

Ad Are You Drowning in Meaningless Metrics. An interim report can be prepared monthly or quarterly or ad hoc when it is required to evaluate a companys financial performance and position at any given time. Get the Guide Now.

Learn the Secrets to Better Reporting with Qlik. Interim reporting is usually required of any company that is publicly held and it typically involves the issuance of three quarterly financial statements each year. Depending on the situation the report can be either full or condensed.

Accounting Standards AS-25 Interim Financial Reporting issued by ICAI in February 2002 observes. Internal Auditors Internal audit refers to the inspection conducted to assess and enhance the companys risk management efficacy evaluate the different internal controls and ensure. An interim financial report is intended to provide an update of the last annual report.

Ad Our range of guidance is designed to ensure best practice financial reporting compliance. Our experts are here to help with accounts audits financial reporting. A financial report that contains either a complete or condensed set of financial statements for an interim period.

Definition of terms Interim reporting pertains to the preparation and presentation of interim financial report for an interim period. Interim period is understood as financial reporting period shorter than full financial year. However local laws and regulations may require a company to prepare interim financial statements and also specify the frequency eg.

/GettyImages-844471454-a435bc7fb9c6406eb7b5d5666721c538.jpg)

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)