Spectacular Industry Standard Financial Ratios

Financial ratios are used to compare one company to another company or to an entire industry in order to measure performance notes.

Industry standard financial ratios. This data helps an analyst benchmark the subject company against industry standards. Companies making a profit that year are presented in a separate table. 22 rows Listed companies analysis Ranking Industry ratios Statements.

Only the industry average is presented but each line of business has more companies represented than the RMA. 220 rows IRS financial ratios is the only source of financial ratio benchmarks created from more than 5 million corporate tax returns collected by the IRS. Balance sheet and income statement information and 14 financial.

Apparel And Accessory Stores. Covering the following ratio types. Current Ratio As an example the current ratio is a straightforward financial ratio with known general practices but its specific value.

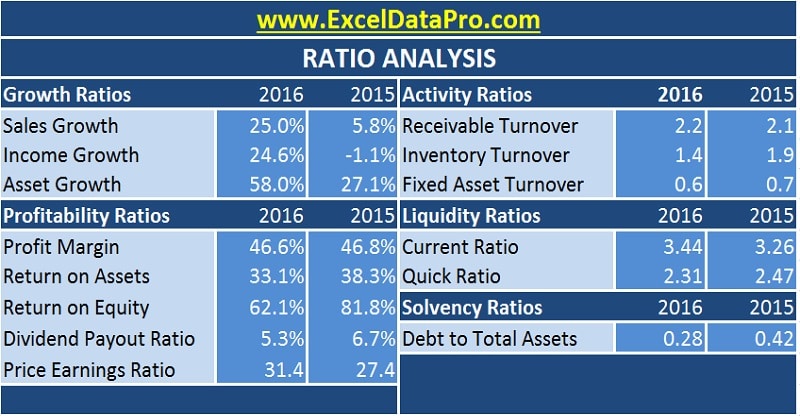

In other words Financial Ratios compare relationships. Learn about finance and accounting with over 100 flashcards coordinated with video audio and traditional lessons. Industry standards for financial ratios include priceearnings liquidity asset management debt and profitability or market ratios.

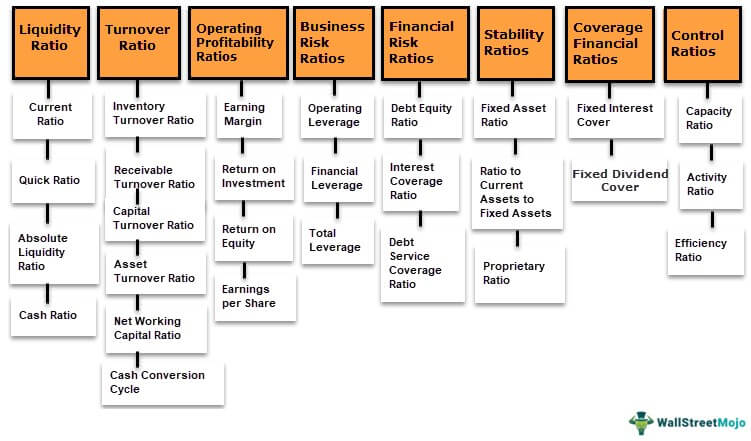

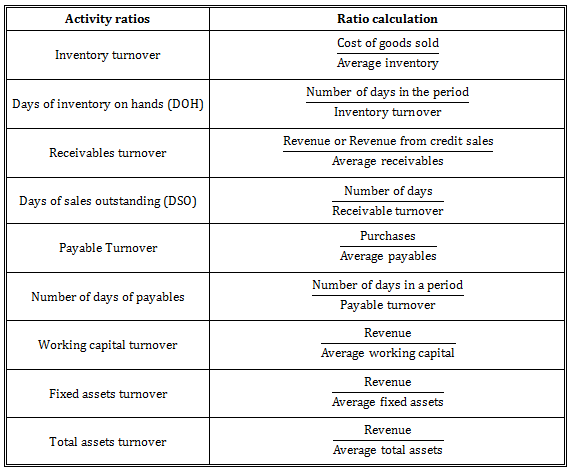

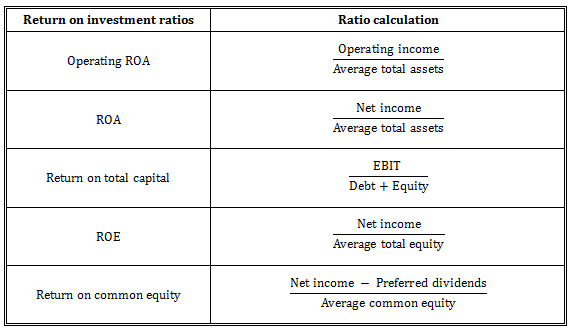

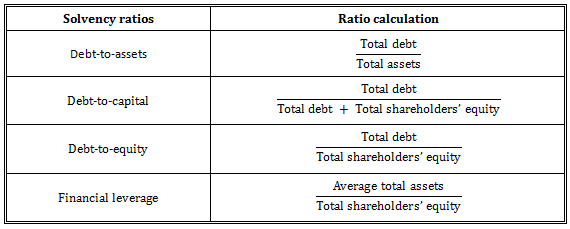

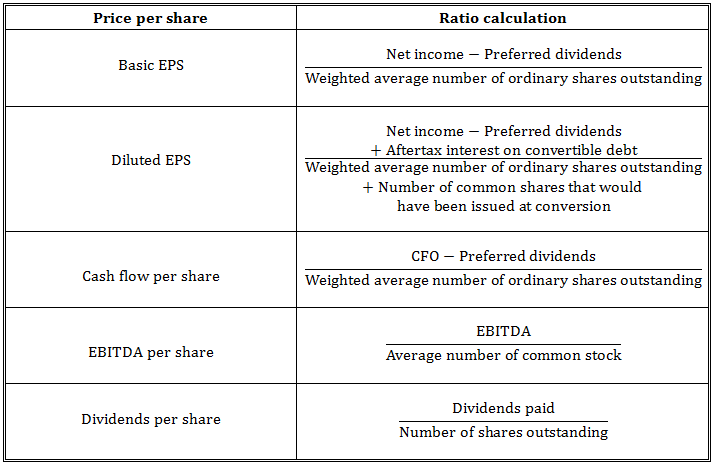

For example an Assets to Sales Ratio Total Assets Net Sales. Profitability ratios to measure business performance liquidity ratios to work out how solvent your business is financing ratios to evaluate financing and investment. The most common types of ratios are.

Current ratio current assets divided by current liabilities. Download from our website or from amazon kindle version Download from our. Price Earnings Price Book Net Profit Margin Price to Free Cash Flow Return on Equity Total Debt Equity and Dividend Yield.

:max_bytes(150000):strip_icc()/ScreenShot2021-05-28at7.09.49PM-f53a583c48954953a7cd0d23454be040.png)