Simple Industry Average Financial Ratios

To search for an industry analysis or a company financial statement analysis within an SIC Code click within the Code column until your industrycompany is displayed or directly input the four digit SIC code for your industrycompanyCompanies displayed under any give SIC Code will be the.

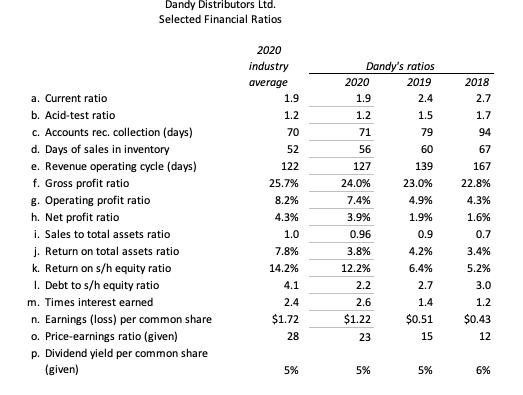

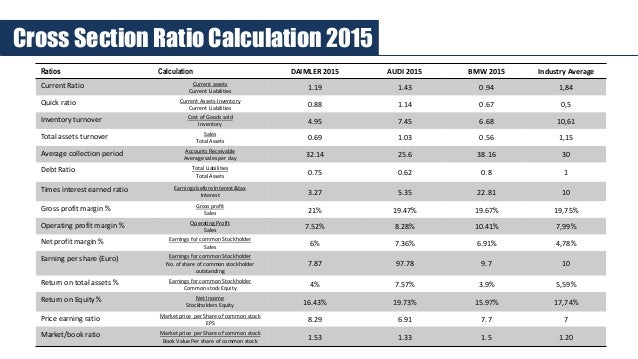

Industry average financial ratios. Using Industry Average Ratios Financial ratios are used to analyze a companys strengths and weaknesses by looking at the ratio of various financial data to each other. Hi Im looking for industry average ratio of yahoo company. 22 rows Listed companies analysis Ranking Industry ratios Statements.

10 or 110 10 or 10 In other words Financial Ratios compare relationships among entries from. Data comes from Dun Bradstreet Key Business Ratios. Ratios convert financial information to a standardized format enabling them to be used to compare different companies to the industry average ratios.

Your source for the most current industry analysis using industry ratios. If the Z-Score is 1. Financial ratios and industry averages are useful for comparing a company with its industry for benchmarking purposes.

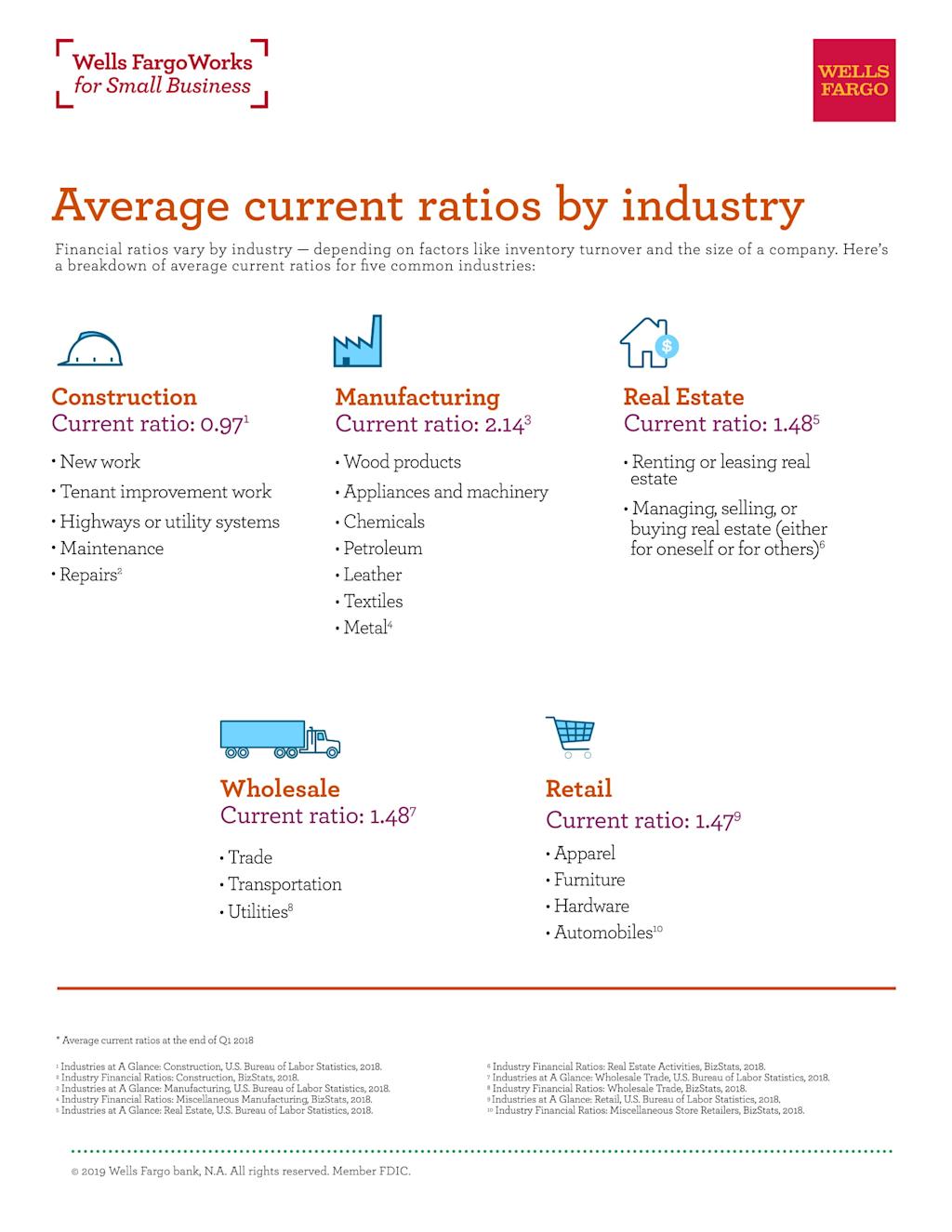

Current ratio current assets divided by current liabilities. Yahoo was acquired by Verizon in 2017 and. Within Financial sector 11 other industries.

Wait a moment and try again. The two most used and effective financial analysis methods employed are ratio analysis and common size financial statements. Current ratio - current assets divided by current liabilities.

By ten on Sep 14 2018. Industry Ratios The use of financial statement anaysis is a time tested method of analyzing a business. For example an Assets to Sales Ratio Total Assets Net Sales Say you have 100000 in Total Assets and 1000000 in Net Sales your Assets to Sales would be 100000 1000000 or 1.