Out Of This World Formula For Net Cash Inflow Of A Project Is

A positive steady income implies that the organizations income will increase.

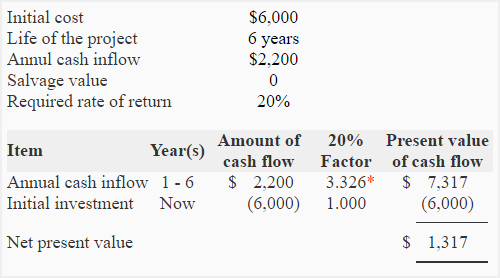

Formula for net cash inflow of a project is. C net cash inflow per period r rate of return also known as the hurdle rate or discount rate n number of periods In this formula it is assumed that the net cash flows are the same for each period. The opening cash balance of the firm is 34 million and if we add net cash flow which is 80 million we will get the closing balance as 114 million. Net present value NPV is a financial metric that seeks to capture the total value of a potential investment opportunity.

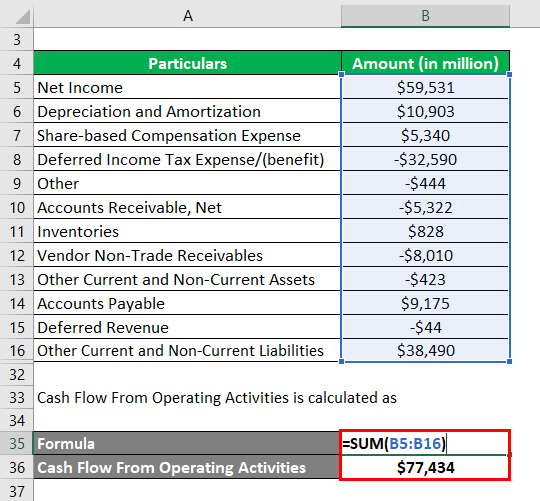

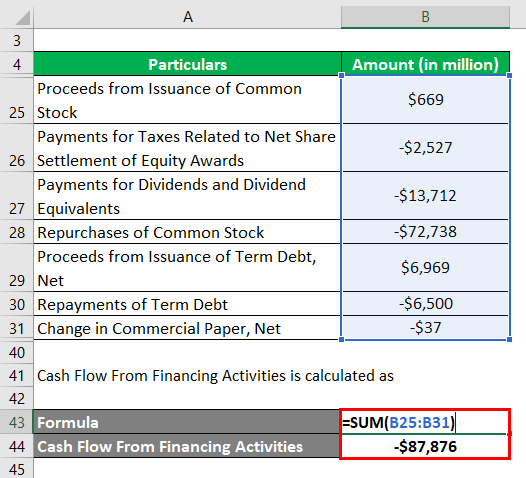

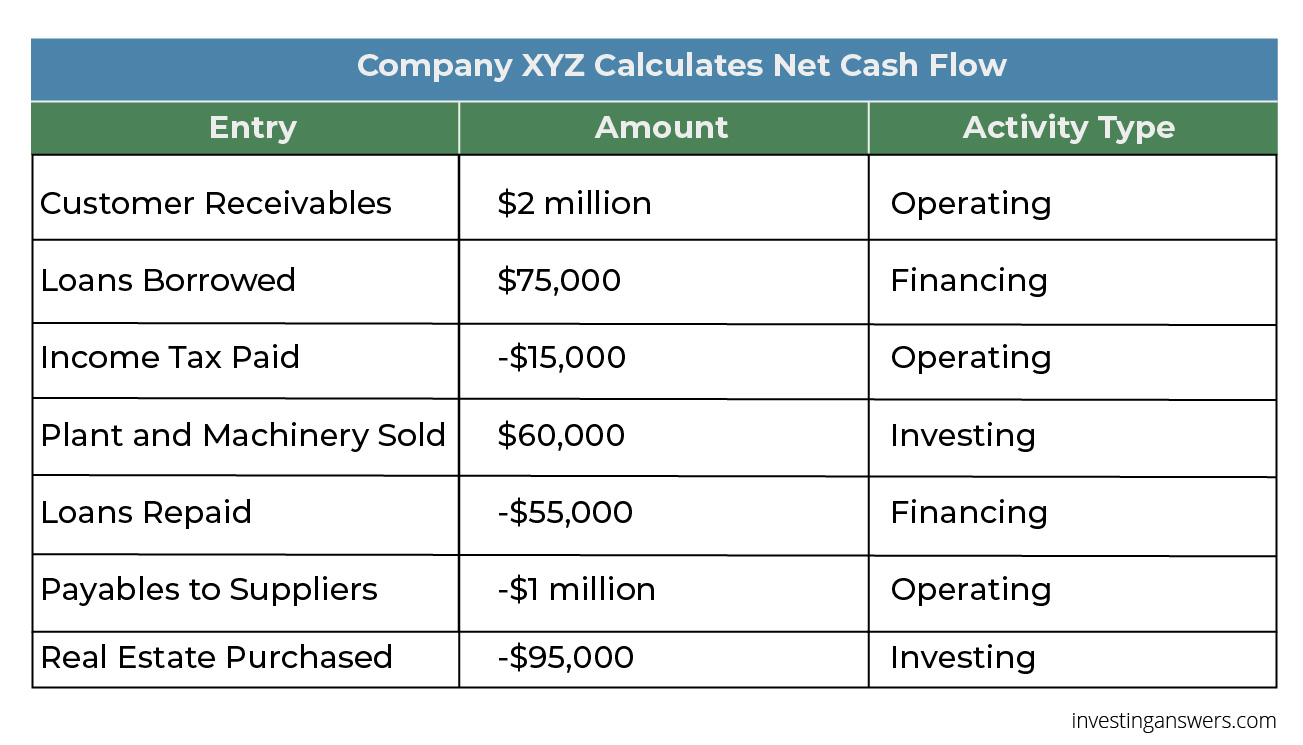

Net Cash Flow will be Net Cash Flow 80 million The Net cash flow for the firm is 80 million. The Net Cash Flow Formula The formula for net cash flow calculates cash inflows minus cash outflows. Add your net income and depreciation then subtract your capital expenditure and change in working capital.

Net Working Capital Current Assets less cash Current Liabilities less debt or NWC Accounts Receivable Inventory Accounts Payable. An incremental cash flow arises when the company opts to execute some new project. N is the period to which the cash inflow.

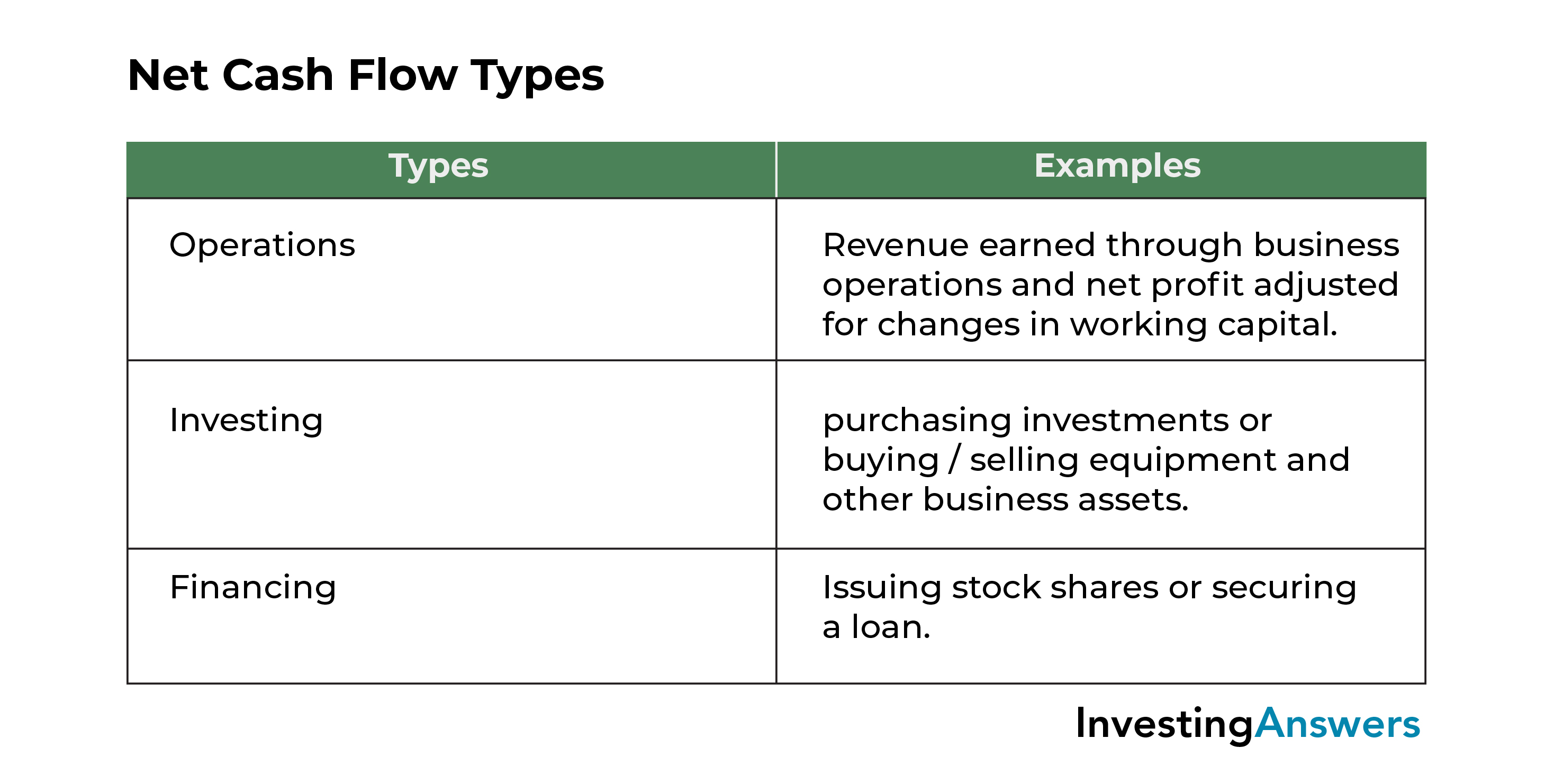

The NPV of the project is calculated as follows. The concepts of sensitivity and specificity were discussed along with positive and negative predictive values PPV and NPV. Usually you can calculate net cash flow by working out the difference between your businesss cash inflows and cash outflows.

Incremental Cash Flow Definition Formula Example and Calculation. Cash inflows must be positive while cash outflows must be negative. You will also add the tax savings on the depreciation of project assets to the expected cash inflows.

Revenue demand x price B4 B3. When net annual cash inflow is even ie same cash flow every period the payback period of the project can be computed by applying the simple formula given below. Likewise what is NPV formula.