Spectacular Five Financial Ratios

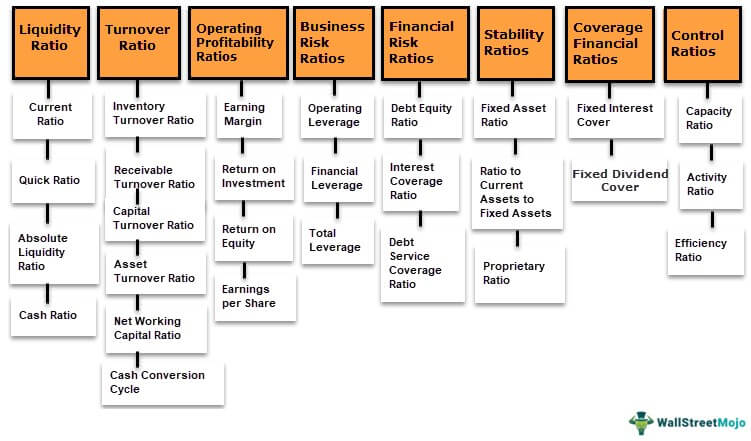

These include price-earnings PE earnings per share debt-to-equity and return on equity ROE.

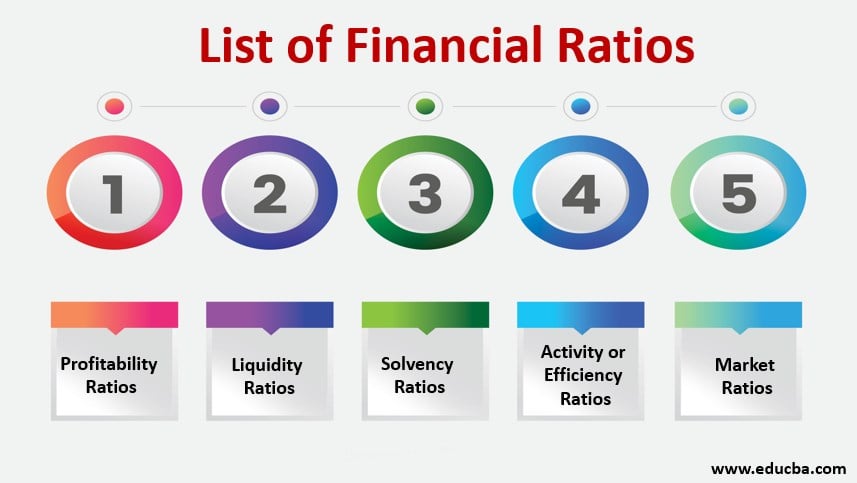

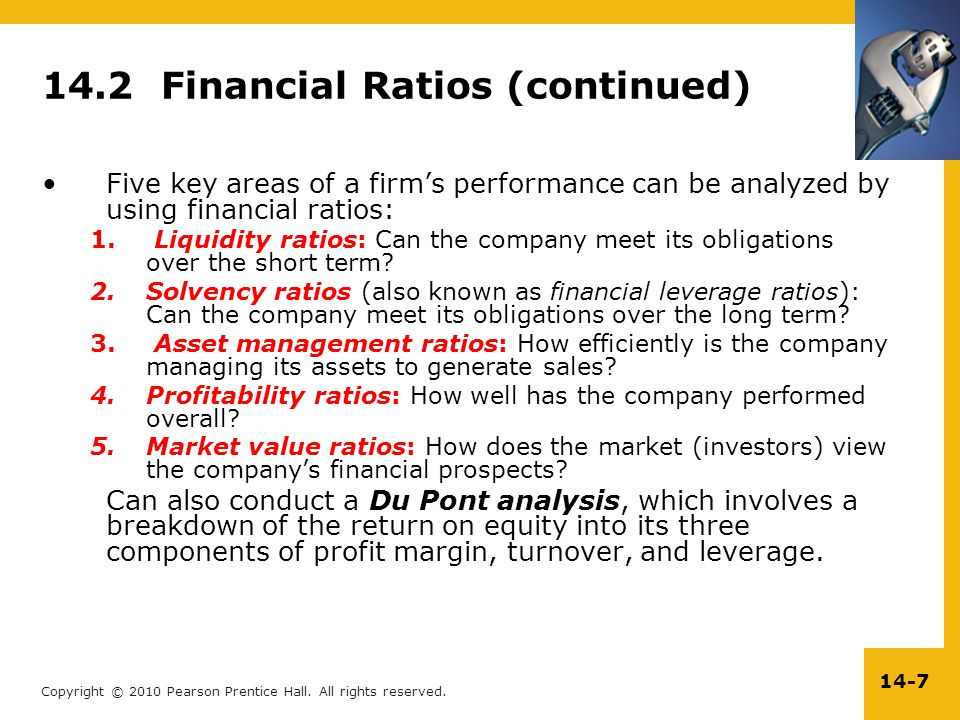

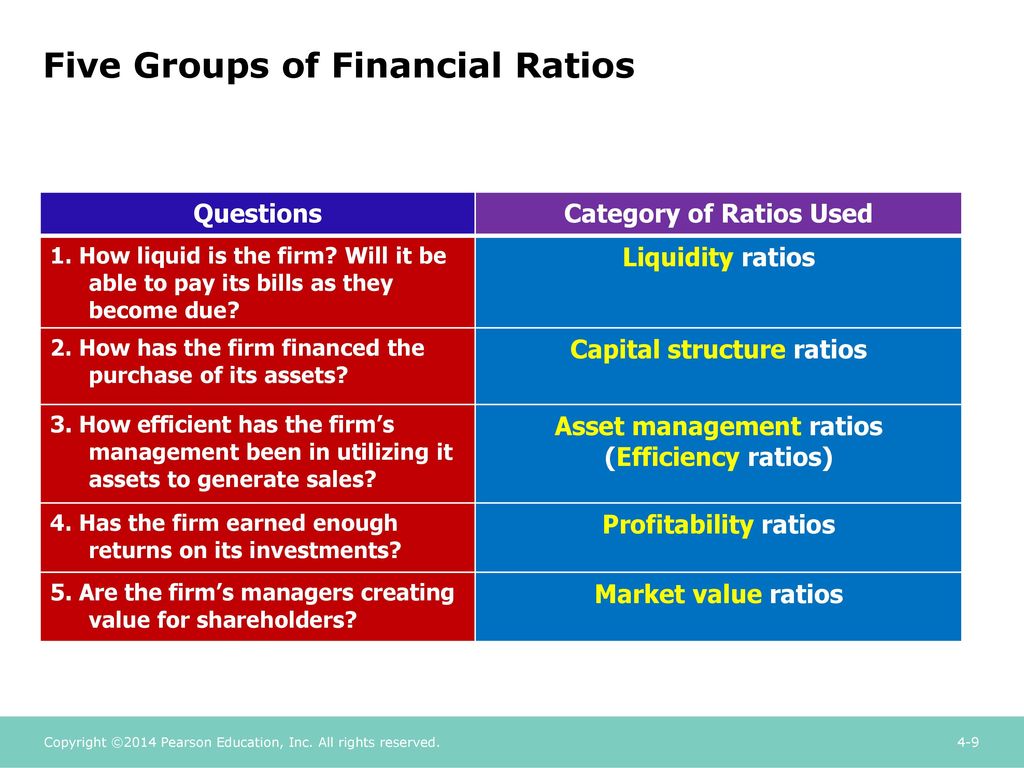

Five financial ratios. A value under 100 is good. Interpretations and Analysis These sections present statistics explanations and analysis of Benedicts financial statistics using Appendices 61 to 65. Financial ratios are created with the use of numerical values taken from financial statements.

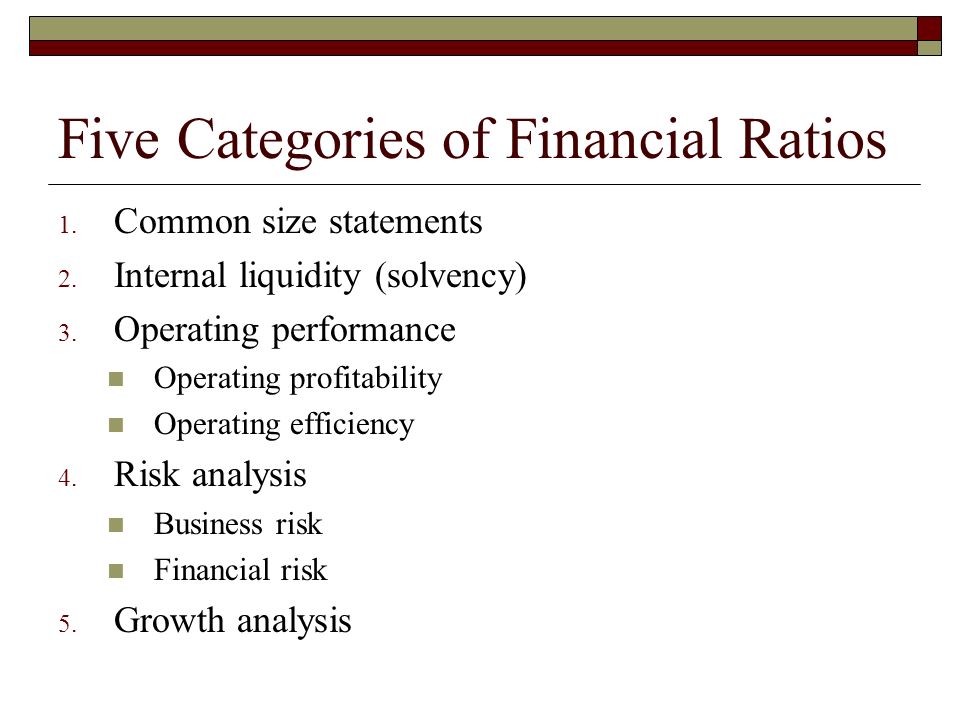

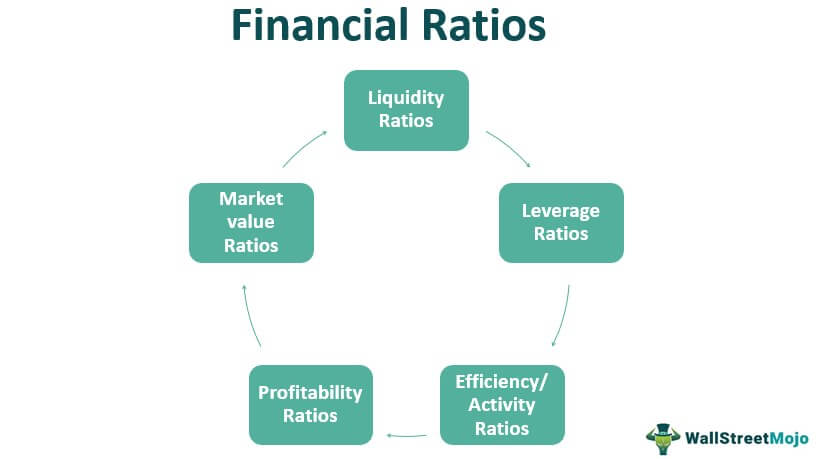

This ratio is calculated by dividing the current share price of a company with its earnings per share. This is defined as the ratio of net income to the weighted average shares outstanding of a company. It helps to classify them into five major categories mentally.

The debt-to-equity ratio is a quantification of a firms financial leverage estimated by dividing the total liabilities by stockholders equity. The financial ratios that give you an idea of the leverage inherent in the business such as the debt-to-equity ratio or other ratios that allow you to see a companys capital structure along with the potential benefits and risks of such a capital structure and how it. The DE ratio compares a companys total debt to its equity.

If you want to check whether your unit economics are sound then download your free guide here. Strategy depends on individual and varies from the person to person. Financial Ratios with Calculations.

321 Liquidity Ratio of Benedict Co Current share and fast share declined from 125 to 119 and from 075 to 070 in the years under review. This ratio generally indicates the profitability of a company. The following five investor ratios are among the most commonly used by equity investors and analysts.

Ten years of annual and quarterly financial ratios and margins for analysis of Amazon AMZN. Five Investor Ratios Definitions and Formulas. Ten years of annual and quarterly financial ratios and margins for analysis of Amazon AMZN.