Breathtaking Fair Value Through P&l

Financial assets held at fair value through profit or loss comprise assets held for trading and those financial assets designated as being held at fair value through profit or loss.

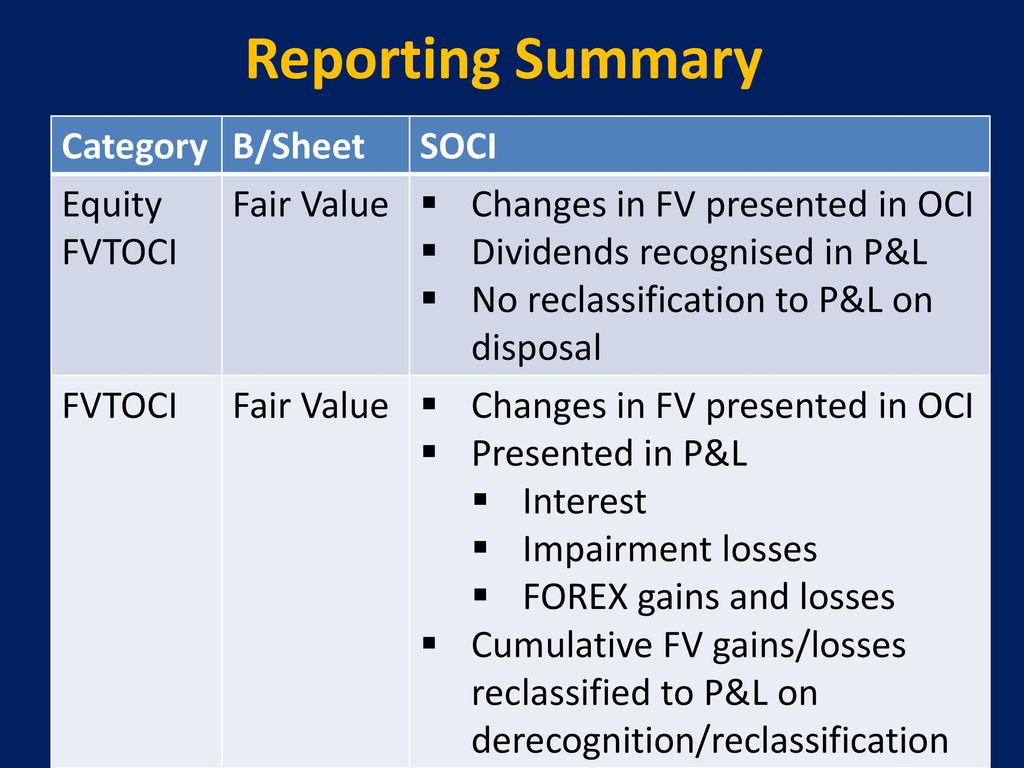

Fair value through p&l. Where assets are measured at fair value gains and losses are either recognised entirely in profit or loss fair value through profit or loss FVTPL or recognised in other comprehensive income fair value through other comprehensive income FVTOCI. Under IFRS 9 the default financial asset measurement category is fair value through profit or loss FVTPL while under IAS 39 it is available for sale which also requires measurement at fair value but results in less volatility in profit or loss because fair value changes are recognised in other comprehensive income. IFRS 13 applies to IFRSs that require or permit fair value measurements or disclosures and provides a single IFRS framework for measuring fair value and requires disclosures about fair value measurement.

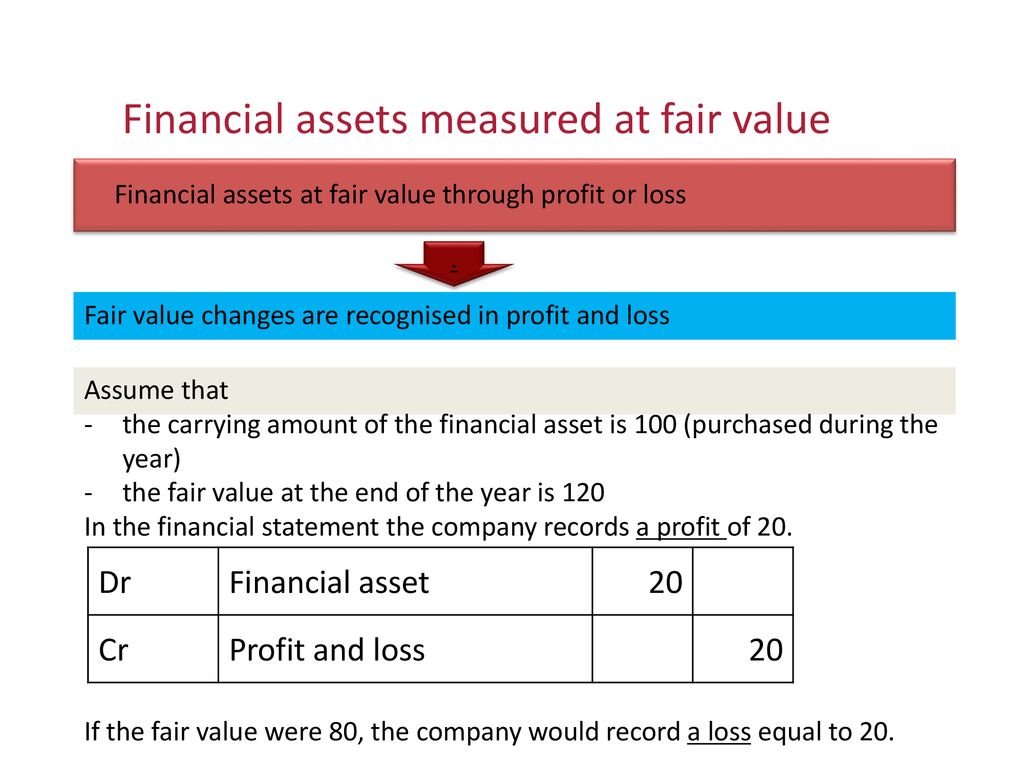

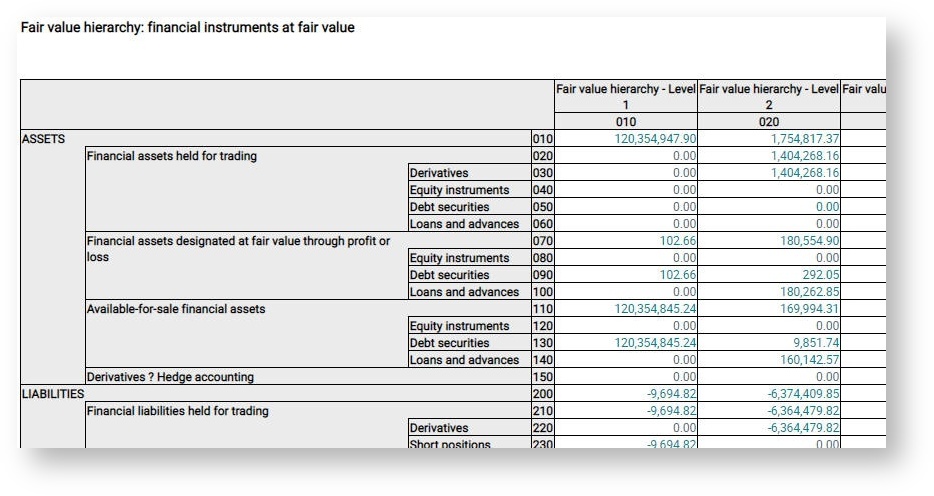

Fair value through profit or loss also abbreviated as FVTPL simply means that if you have an asset you measure that asset at fair value on each reporting date and record the resultant fair value gain or loss in the profit of loss section of the Statement of profit or loss and other comprehensive income. The Standard defines fair value on the basis of an exit price notion and uses a fair value hierarchy which results in a market-based rather than entity-specific measurement. The new standard is based on the concept that financial assets should be classified and measured at fair value with changes in fair value recognized in profit and loss as they arise FVPL unless restrictive criteria are met for classifying and measuring the asset at either Amortized Cost or Fair Value Through Other Comprehensive Income FVOCI.

Most of the gains or losses go through P. ZLoans and receivables and held to maturity financial assets are measured at amortised cost. On 1 January 201 financial asset will be recognized at its fair value.

This risk arises from instruments which are classified as Fair value through PL or Fair value through. Fair value through PL is measurement at fair value where any changes in value are recognized directly in profit or loss. Fair value through profit or loss or available for sale categories.

Fair value through other comprehensive income FVTOCI. Fair value through profit or lossany financial assets that are not held in one of the two business models mentioned are measured at fair value through profit or loss. When and only when an entity changes its business model for managing financial assets it must reclassify all affected financial assets.

Under old UK GAAP revaluation gains or losses on fixed assets would be taken to revaluation reserve. If a non-equity financial asset fails the SPPI test it must be classified at Fair Value Through Profit or Loss FVTPL in its entirety. Any Gain or losses are reported through Income Statement PL or Other Comprehensive Income OCI.