Breathtaking Treatment Of Provision For Doubtful Debts

The total of the list is the provision required.

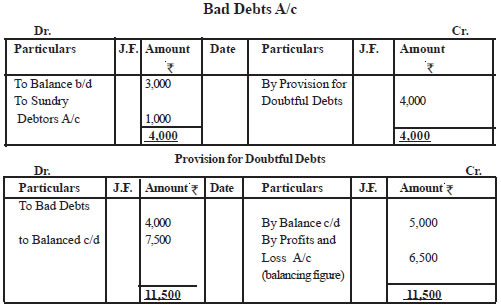

Treatment of provision for doubtful debts. A list of all amounts agreed to be provided for should be prepared and then approved jointly by the SM-SD at HO and the concerned Branch Head. Example of Provision for Doubtful Debt Example of Provision Creation. General provision for doubtful debts is still not tax-deductible.

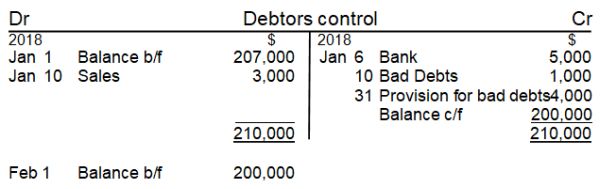

Sayat end of Quarter 2 we have reviewed our trade debtors and wanting to increase the provision by an additional amount 50000. Apply certain percentage of provision to each ageing group of receivables based on management estimates. Accounting Treatment For The Increase Or Decrease Of Provision For Doubtful Debts.

Accounting Treatment of Provision for doubtful debts Before doing accounting treatment of provision for doubtful debts you must know the complete definition of provision. In accounting it is a reserve that is against loss due to non payment of debtors. Debit Dr Income statement.

Recording increase in provision for doubtful debts. The bad debt provision may affect your cash flow statement but it isnt one of the items the cash flow statement records. Assuming earlier in Quarter 1 we have created a provision for doubtful debts of 100000.

While provision for doubtful debts needs to be recorded as an expense in. That is the management may apply say 2 to all receivables from 30 to 60 days 10 to all receivables from 61 to 180 days and 100 to. Creation of provision for the first time writing off the bad debt against provision in next year and creating a new provision at the end of next year.

The procedure for the recording of the provision for doubtful debts is shown below. Debit Dr Income statement. Show treatment of Provision for Doubtful Debts in the Balance Sheet of ABC Ltd.