Perfect Assertions For Accounts Payable

8 rows Hence the financial statements contain managements assertions about the transactions.

Assertions for accounts payable. Audit assertions for accounts payable Completeness Accounts payable balances reported on the balance sheet include all payable transactions that have occurred during the accounting period. The existence assertion for accounts payable includes. Focus specifically on each of the following balance-related management assertions for the inventory account.

In this type of situation AP plays a. For companies doing business in or with the United States accounts payable audit procedures are ideally guided by auditing stan dards set forth by the American Institute of Certified Public Accountants AICPA. Enough audit procedures are necessarily applied to.

O Audit Assertions Objectives and Procedures Assertions 1 Audit Assertions for Accounts Payable Assertions that we usually need to test in the audit of accounts payable are included in the following table. AP can help maintain healthy relationships with vendors provide detailed visibility into cash flow and even help the company save money. Assertions about Account Balances - Completeness.

The rights and obligations assertion means that the company actually owes a liability for accounts payable at the reporting date. The primary relevant accounts payable and expense assertions are. The accuracy of the invoice is checked after which the.

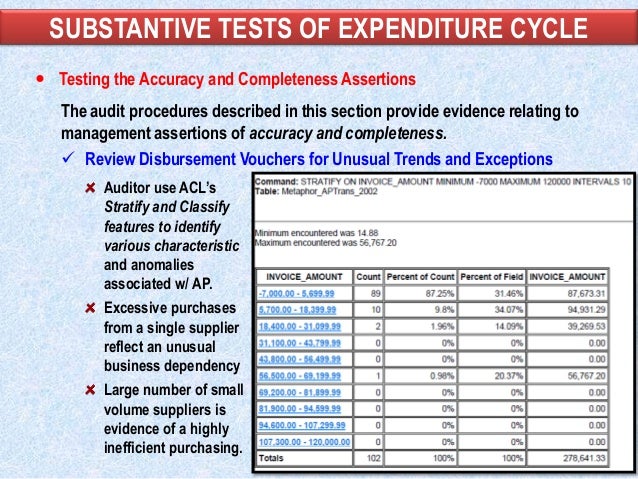

Obtain listing of accounts payable and agree total to general ledger. When accounts payable departments are run correctly theyre an invaluable piece of an organization. In the accounts payable audit the completeness assertion is the most relevant assertion as the understatement of accounts payable is our major concern.

Trade creditors or payables or accounts payable are the balances outstanding that are to be paid to the creditors or other parties to supply the different types of services or products to the company. This may be due to an intentional act of account manipulation or fraud tends to make accounts payable understated rather than overstated. This ensures the audit achieves four critical benchmarks for clarity accuracy and comprehensivenessnamely.