Outrageous State Of Comprehensive Income

The purpose of the statement of profit or loss and other comprehensive income OCI is to show an entitys financial performance in a way that is useful to a wide range of users so that they may attempt to assess the future net cash inflows of an entity.

State of comprehensive income. Amounts earned from transactions in securities of related parties shall be disclosed as required under 2104-08 k. The statement of other comprehensive income represents a companys change in equity during a specific period from transactions and events that are typically non-cash gains and losses. In other words it adds additional detail to the balance sheets equity section to show what events changed the stockholders equity beyond the traditional net income listed on the income statement.

IAS 1 para 81 allows that all the items of income and expenses recognized in the period. Comprehensive income is the sum of regular income and other comprehensive income. The main example is the revaluation of tangible assets.

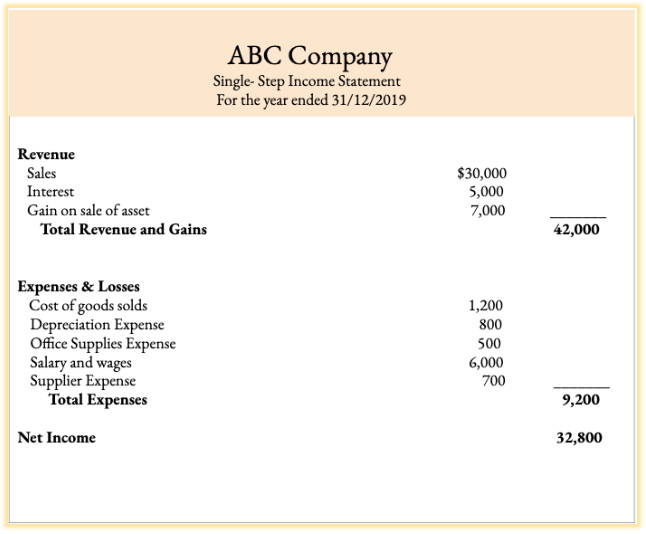

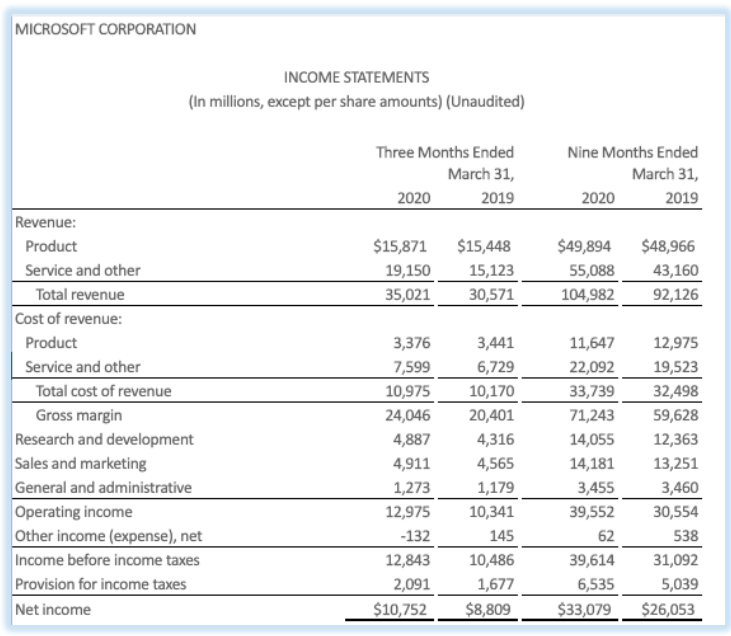

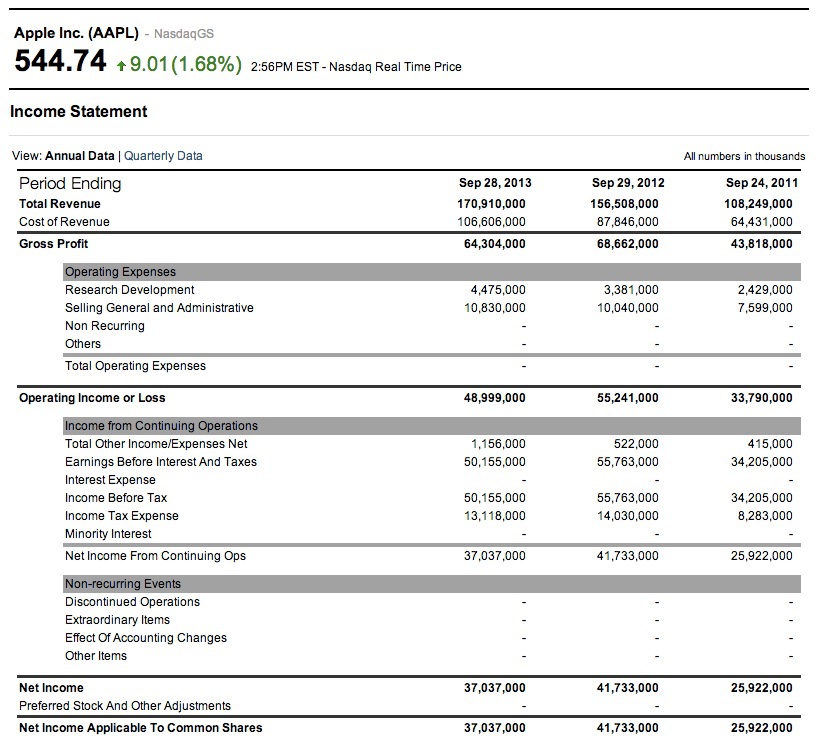

The statement of comprehensive income reports the change in net equity of a business enterprise over a given period. Statement of Comprehensive Income refers to the statement which contains the details of the revenue income expenses or loss of the company that is not realized when a company prepares the financial statements of the accounting period and the same is presented after net income on the companys income statement. Comprehensive income is often listed on the financial statements to include all other revenues expenses gains and losses that affected stockholders equity account during a period.

A more complete view of a companys income and revenues is shown by. Definition of Comprehensive Income. The gain is not realised until the asset is.

Comprehensive income includes a net income and b other comprehensive income. Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized including items like an unrealized holding gain or loss from available for sale securities and foreign currency translation gains or losses. What is comprehensive income.

Income current period reclassifications out of accumulated other comprehensive income and other amounts of current-period other comprehensive income. State separately in the statement of comprehensive income or in a note thereto amounts earned from a dividends b interest on securities c profits on securities net of losses and d miscellaneous other income. Both before-tax and net-of-tax presentations are permitted provided the entity complies withthe requirements in paragraph 220 10-45-12correspond to the - components of other comprehensive income in the statement in which other comprehensive income.