Unique Quickbooks Profit And Loss Report Wrong

Run your Business Anytime Anywhere.

Quickbooks profit and loss report wrong. In QuickBooks the original entry is on a form invoice bill check and so on and the equivalent of a ledger is a report. Then follow these steps. Ad See three simple steps to convert your file.

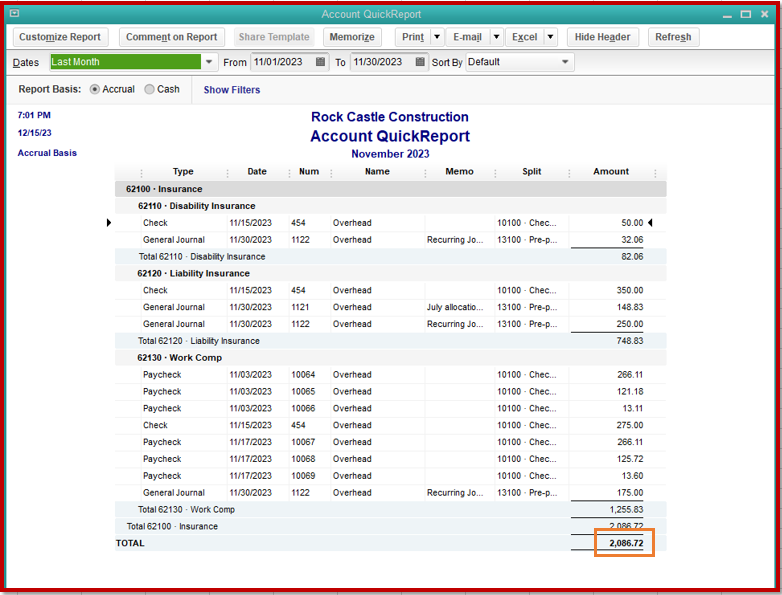

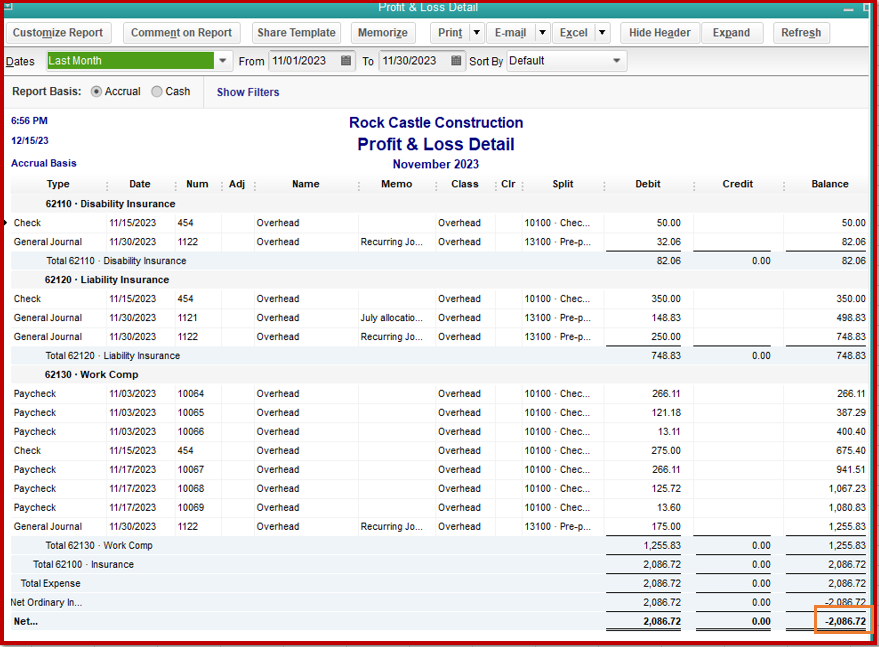

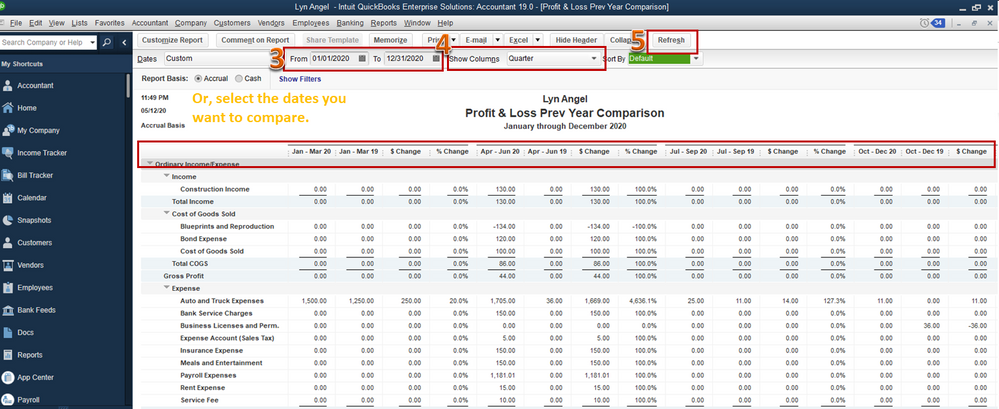

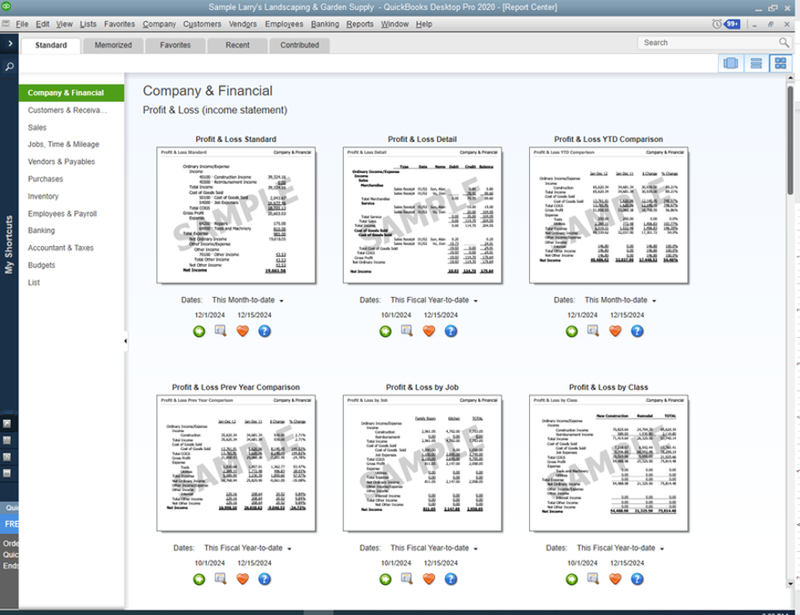

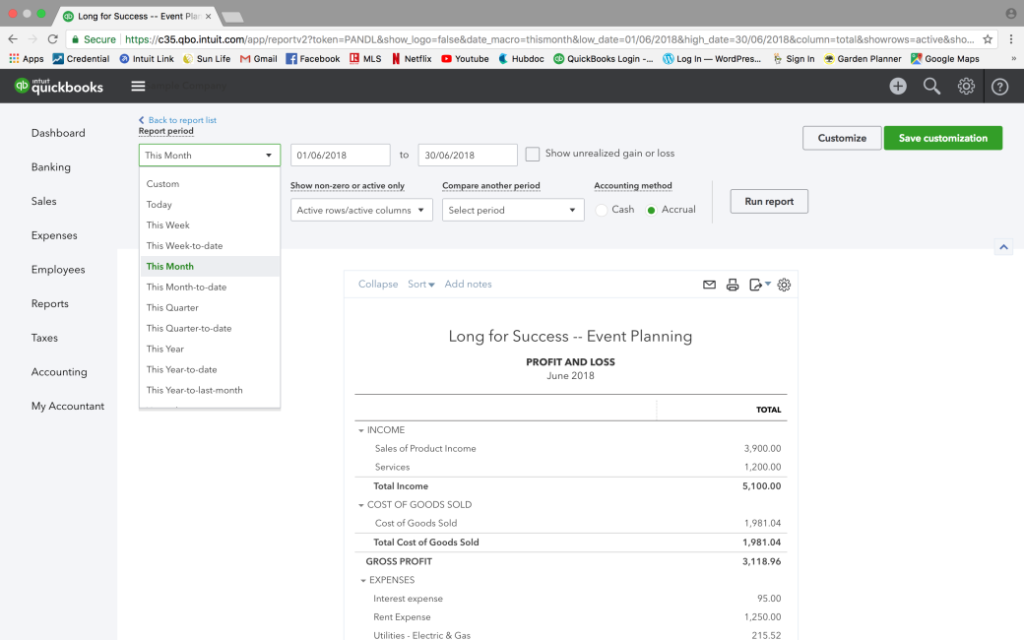

Profit Loss Standard Used to report on the nonprofit on a high level combined basis Profit Loss by Class program Profit Loss by Job funding source Budget Versus Actual combined basis Budget Versus Actual by Class program. The Raw Materials Expense account will a fake account that is only intended to be shown on the Cash based reports and cant be linked to an actual account in the Accounts Lists. It shows your income expenses and profit or loss over a certain period.

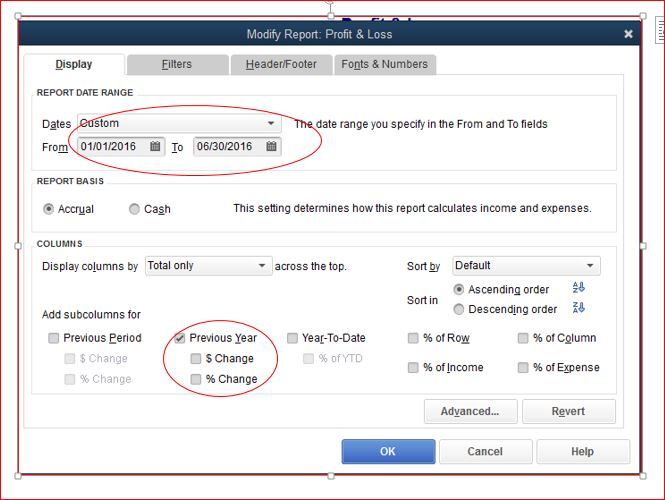

Use basic standard profit and loss reports in QuickBooks to produce very useful information as follows. You will need to reduce this amount for Total Income on the Profit Loss by the amount of discounts taken before attempting to reconcile the two reports. All possible reasons are listed in every one of the reasons that may get you mistakenly determined profit and loss reports in QuickBooks.

Locate the report titled Profit and Loss Report Standard. 4 days ago Jun 23 2021 To view a job costing report in QuickBooks Online select Reports from the left menu Standard tab Profit and Loss. If you have chosen the wrong sales record to pull up the sales things this error will pops-up on your screen.

This ledger will give you the foreign curency amount the exchange rate and the AUD amount. The premise behind this is properly setting up. This ensures that filters are not blocking information.

Ad With the Odoo Accounting apps do more in less time. No Contract or Setup Fee with Xero. Move the bank fee into your Profit and Loss account Bank charges.