Ideal Pro Forma Financial Statements Are Used To

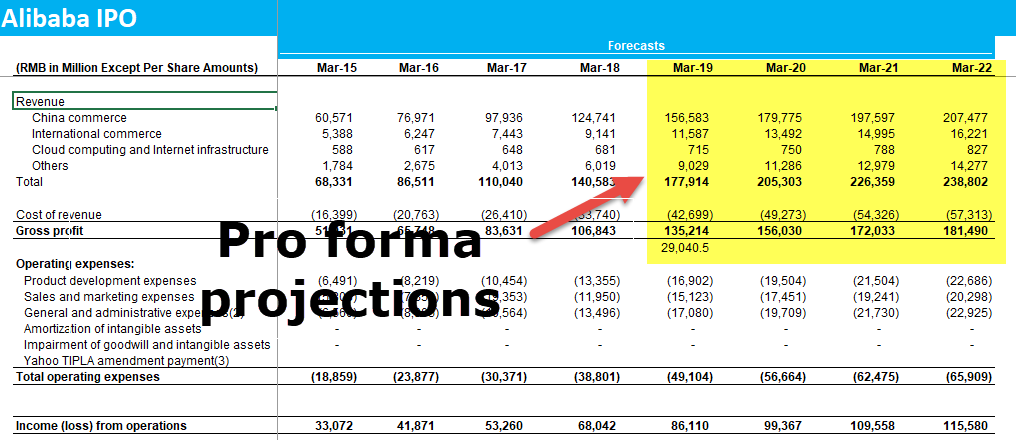

They consider both the best case scenario and the worst case scenario allowing you to have a more knowledgeable approach to your business transactions.

Pro forma financial statements are used to. And theyre not just for big corporations. Pro forma a Latin term meaning as a matter of form is applied to the process of presenting financial projections for a specific time period in a standardized format. Read moreThese statements perform analysis on the financials of the Company.

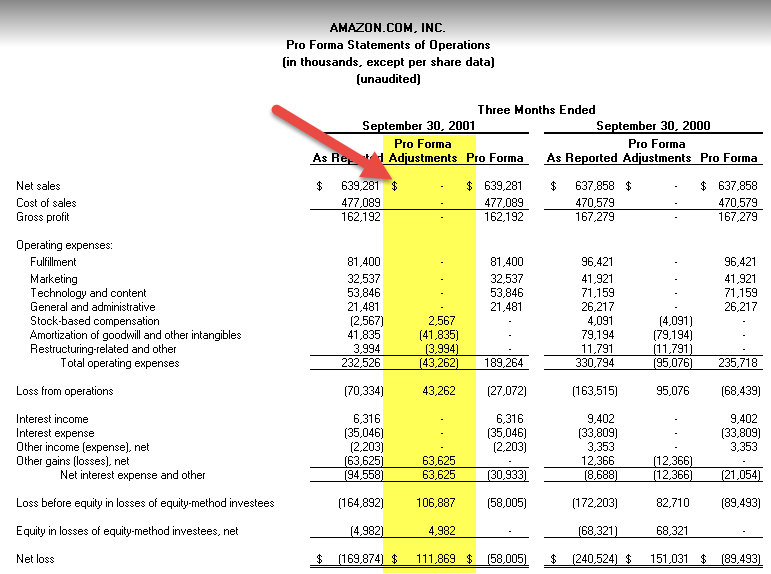

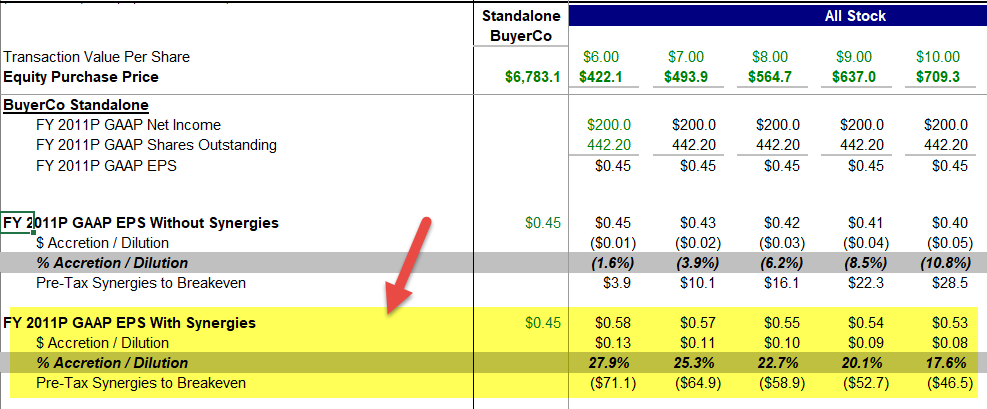

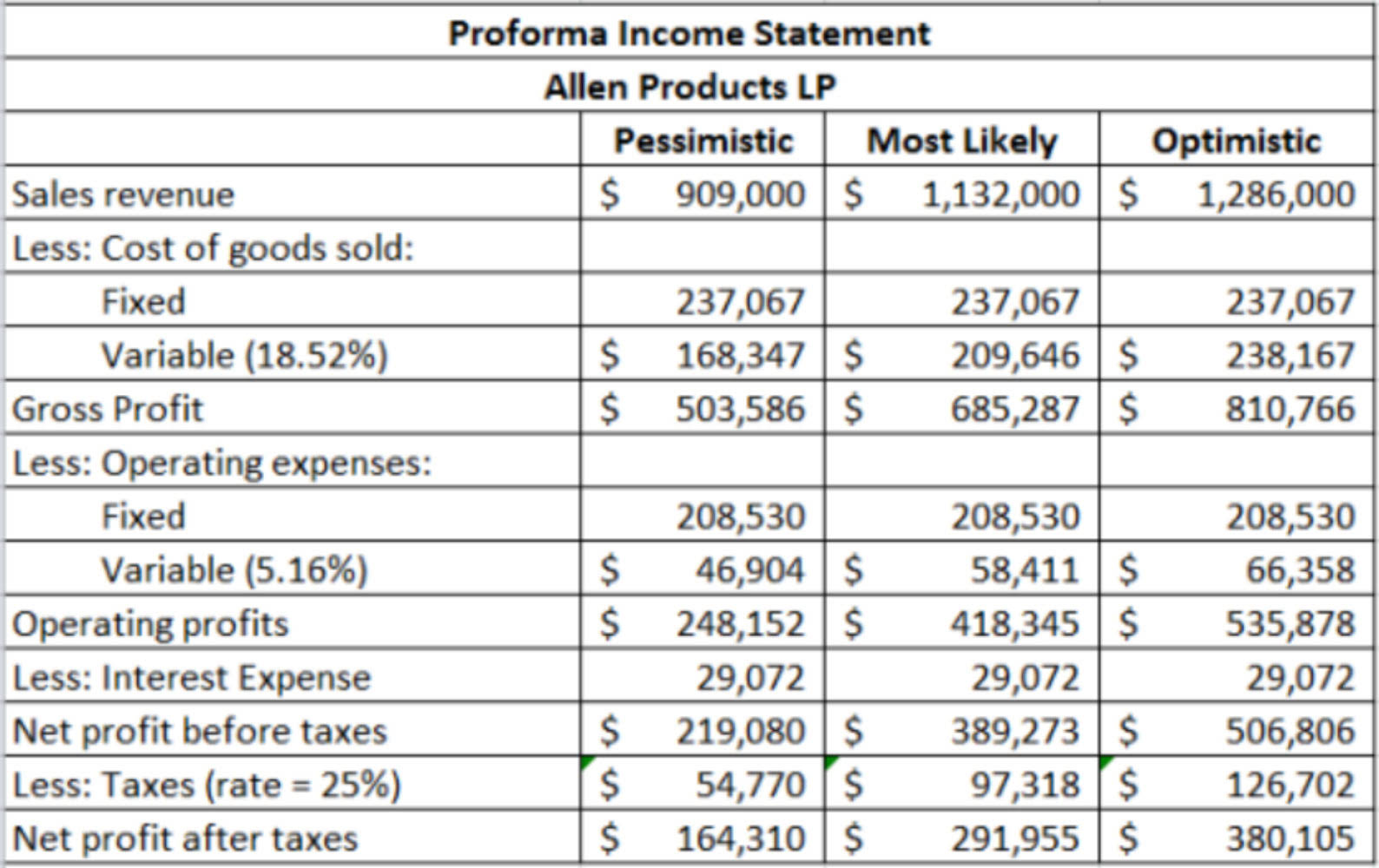

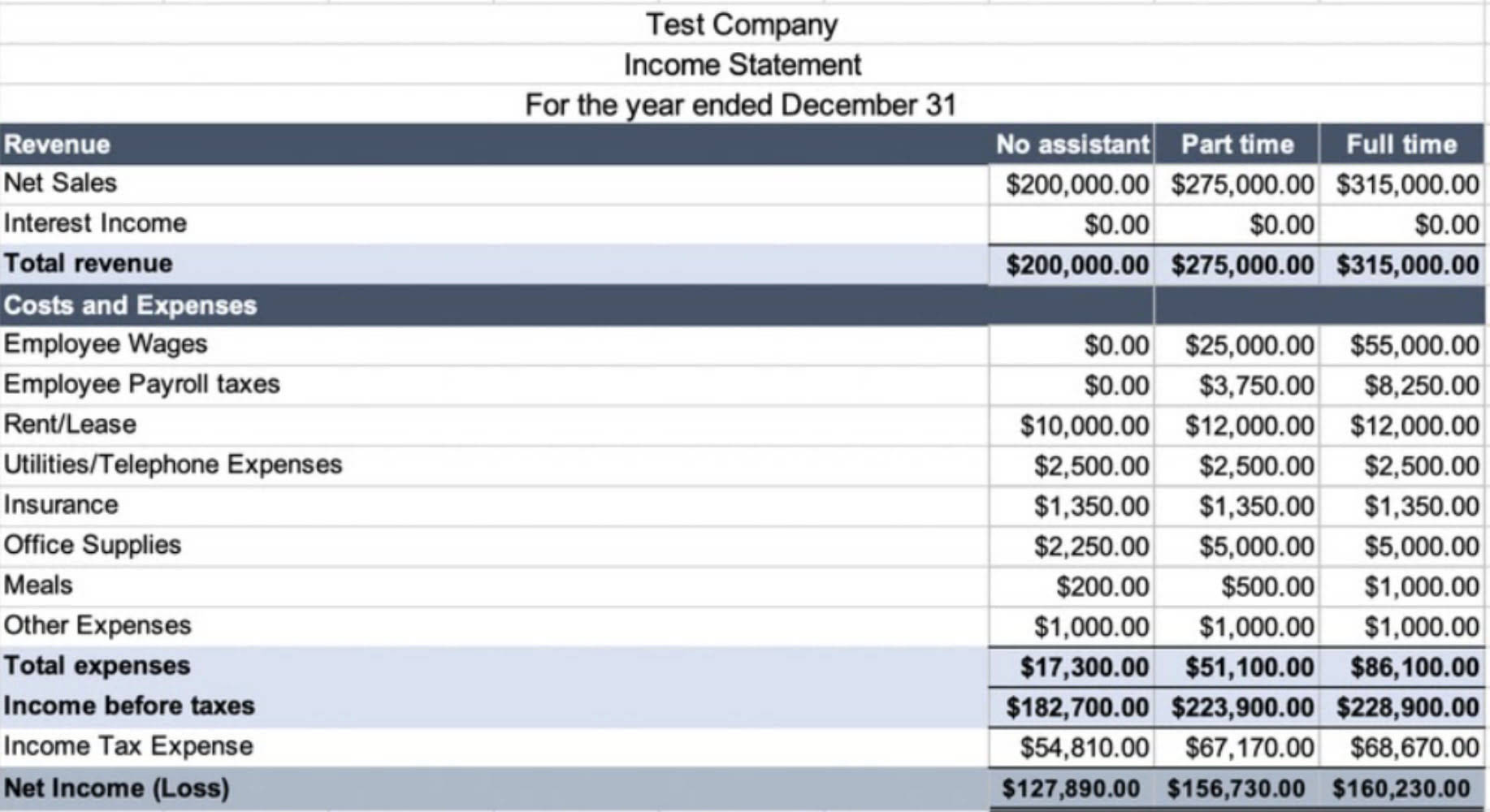

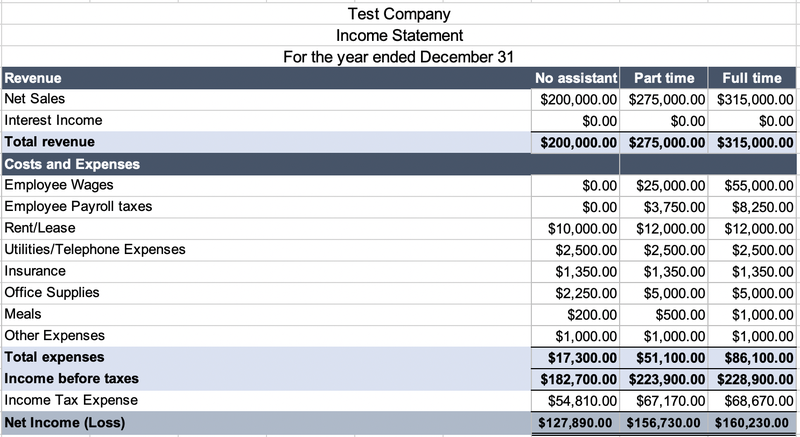

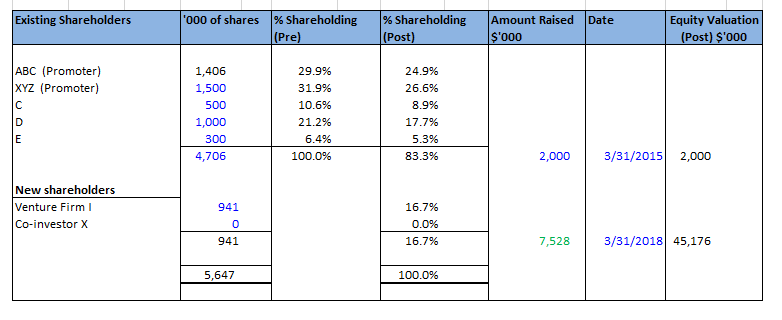

Pro forma statements that give effect to a business combination using the purchase method of accounting generally require only two pro forma adjustments. Often used to back up a lending or investment proposal they are issued in a standardized format that includes balance sheets income statements and statements of cash flow. Example of Pro Forma Financial Statement A corporation may want to see the effects of three possible financing options.

Pro forma financial statements are valuable tools managers can use to plan for the future anticipate and control risks and acquire funding for their business. A pro forma and its statements are an essential part of a business plan. What are Pro Forma Financial Statements.

As we said a pro forma statement is a look at a what-if scenario. These can be used as a planning tool to set standards for the future operations and activities of the business. Pro-forma financial statements are created by looking at and predicting budget changes based on various factors.

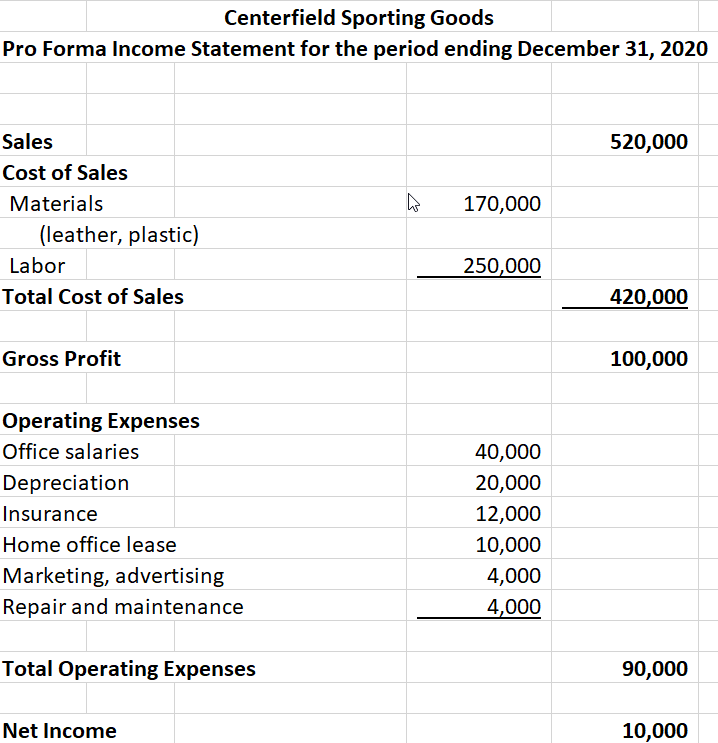

The income statement is perhaps the most important of all pro forma statements. Pro forma financial statements are sought after by investors and entrepreneurs for different reasons. Pro forma statements can be used in risk analysis Risk Analysis Risk analysis refers to the process of identifying measuring and mitigating the uncertainties involved in a project investment or business.

Financial reporting comes standard with Bench. A pro forma income statement is a financial statement that uses the pro forma calculation method mainly to draw potential investors focus to specific figures when a company issues an earnings. Big corporations who have in-house accountants use pro forma statements for financial modeling different scenarios.

/pro-forma-invoice--1053078376-3fb3269f97f84b93832c203f105ac972.jpg)