Beautiful Work Impairment Of Goodwill Ind As

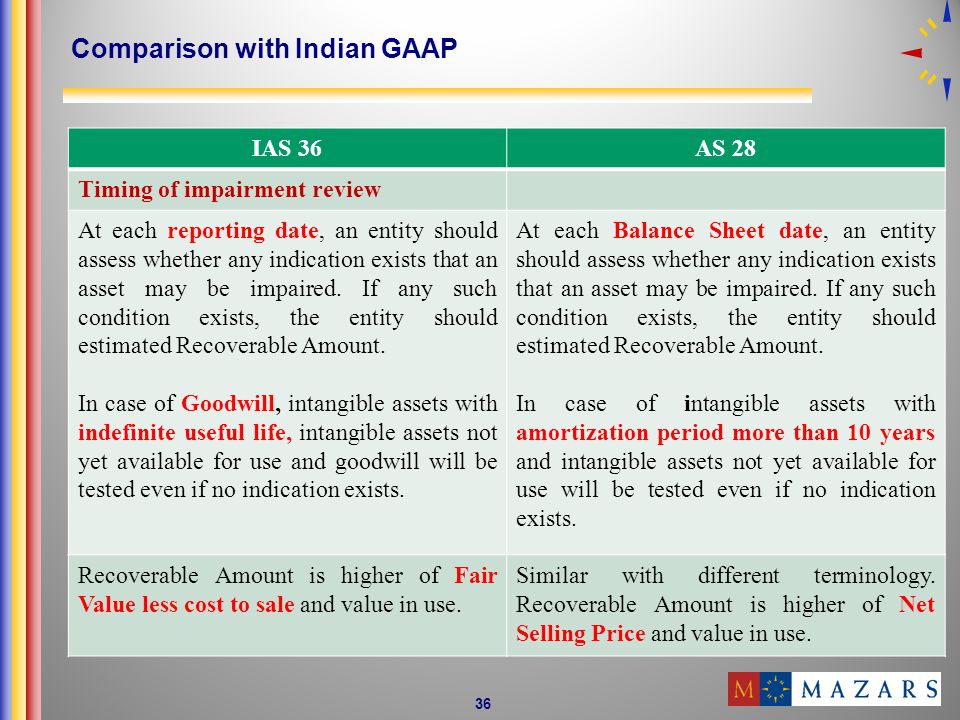

After initial recognition goodwill and indefinite-lived intangible assets are tested for impairment under ASC 350 at least annually or upon the occurrence of a triggering event.

Impairment of goodwill ind as. Companies must test goodwill for impairment annually but stakeholders have mixed views about whether this test is effective. If the total headroom decreases ieTHT1 THT0 it is presumed that there is an impairment of acquired goodwill amounting to THT1THT0unless that presumption is rebutted. Impairment loss except goodwill can be reversed if and only if there has been a change in estimates not because of increase in PV of cash flows as they become closer Increased carrying amount not to exceed the carrying amount that would otherwise exist if no impairment loss had been recognized.

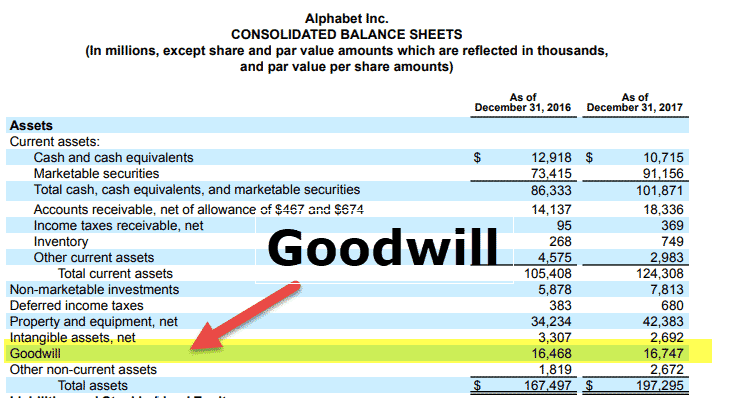

Ind AS 103 prohibits use of pooling of interest method for business combination. An impairment loss is the amount by which the Carrying Amount CA of an asset or a cash-generating unit exceeds its. In Ind AS goodwill is not allowed to be amortised.

Since goodwill is not a separate entity or asset it is not possible to conduct an impairment testing for goodwill as an individual asset. There is no fair value of the goodwill and does not actually bring in anything to the company. It is always tested for impairment.

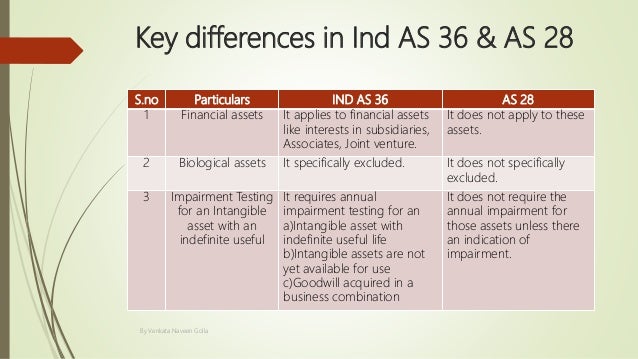

Acquired Internally generated intangibles Under IND AS36 irrespective of an indication of impairment annual impairment. Additionally under Ind AS this asset is no longer amortised but tested for impairment annually. With the exception of goodwill and certain intangible assets for which an annual impairment test is required entities are required to conduct impairment tests where there is an indication of impairment of an asset and the test may be conducted for a cash-generating unit where an asset does not generate cash inflows that are largely independent of those from other assets.

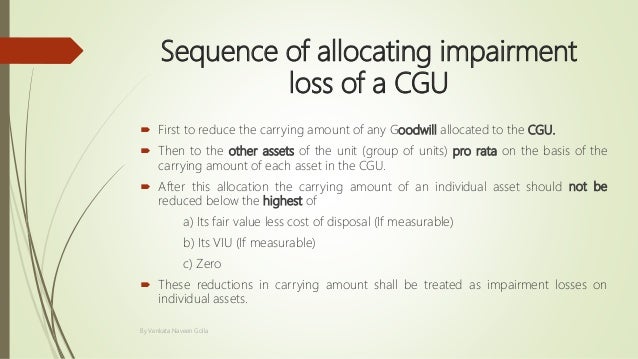

Goodwill should be tested for impairment annuallyTo test for impairment goodwill must be allocated to each of the acquirers cash-generating units or groups of cash-generating units that are expected to benefit from the synergies of the combination irrespective of whether other assets or liabilities of the acquiree are assigned to those units or groups of units. This standard shall not. However the carrying amount of an asset after allocation of the impairment loss cannot decrease below its recoverable amount fair value less cost of disposal or zero.

An impairment charge is a relatively new term used to describe for writing off worthless goodwillThese charges started making headlines in 2002 as companies adopted new accounting rules and. For CGUs the impairment loss is allocated to goodwill first and then to the rest of the assets pro rata on the basis of the carrying amount of each asset IAS 36104. D For impairment of other financial assets refer to Ind AS 39.